The new licensing regime has provided a significant opportunity for accountants to consolidate their positions as the most trusted financial advisers, Andrew Doherty writes.

Many accounting clients would prefer to receive guidance on wealth creation from their accountant – the person they trust the most, according to market researcher CoreData. Changes in the financial services regulatory regime provide accountants with this opportunity, thus creating exciting revenue growth options as well as increased client satisfaction.

This development expands the market because many clients who have not in the past consulted a financial planner can now access guidance on preserving capital and increasing wealth from their own accountant. Client wellbeing is boosted by those accountants who now can offer a complete, holistic approach to their clients’ financial matters.

Customer need: financial advice boosts client wellbeing

Expanding the availability of reliable wealth advisers can only be a good thing for the community for a variety of reasons.

Managing complexity: Wealth management can be complex. Understanding investments, superannuation, risk insurance and tax, then sorting through the various options available and selecting one that is the best for them is daunting and extremely time consuming for most people.

Achieving financial goals: Individuals who receive professional guidance are more likely to meet their short and long-term financial and life goals. Wealth advice can help individuals avoid mistakes, manage risks, be tax efficient, plan for retirement and build long-term wealth.

Security in professionalism: Wealth advice gives individuals comfort and security knowing their financial affairs are being looked after, greater confidence over their financial future and peace of mind, allowing them to sleep more easily at night.

That obtaining financial advice boosts client wellbeing is supported by Queensland University of Technology research that surveyed financial planning clients before and after receiving advice. It found, after taking advice, “clients feel more in control of their finances, have lower levels of stress, are more comfortable with their situations, are more prepared for contingencies, and put more effort into their finances than before”.

Individuals benefit greatly from professional investment guidance

Investing takes experience, time, discipline and commitment to thoroughly analyse economic, industry and individual company fundamentals to make more likely the preservation of capital and generation of superior and more certain returns.

To their detriment, too many investors chase quick gains by taking bets on hard-to-predict factors like volatile commodity prices or next year’s company earnings. Others are ruled by emotions and follow the herd or anchor decisions on recent trends and assume they will last indefinitely.

Individuals without the requisite time and skills are better off seeking professional guidance, particularly from independent investment advisers who are free of incentives to encourage transactions.

Individuals have a poor record of managing their portfolios on their own, according to research by United States-based financial services research firm Dalbar. Dalbar studied total managed fund applications, redemptions and exchanges and concluded individuals are poor market timers. It found investors tend to sell after making paper losses, invest only after the market has rebounded and don’t remain invested for long enough to derive ample benefit.

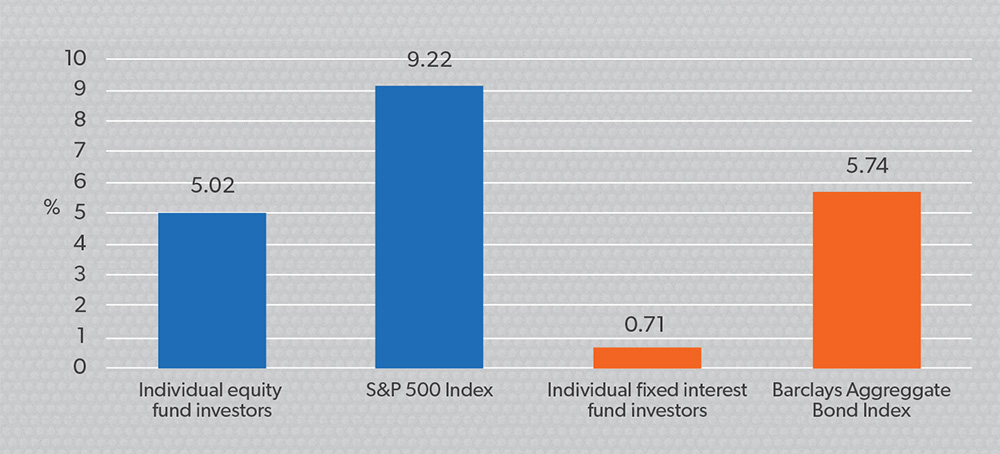

Over 20 years while the broad US equities index, the S&P 500, rose 9.2 per cent a year, individual investors in equity managed funds returned just 5.0 per cent. Bonds rose 5.7 per cent yearly in this time, while bond fund investors generated just 0.7 per cent a year. The funds they invested in tended to rise broadly in line with the index on average (See Figure 1).

Figure 1

Getting asset allocation right is critical to guiding wealth creation

Guiding investors to an appropriate asset allocation and investment strategy is among the most valuable services advisers provide. Advised investors are better diversified across asset classes than those who are non-advised. The global financial crisis was a disaster for investors on the verge of retirement. There are too many stories of people, over-weighted in shares, seeing their life savings evaporate, pushing comfortable retirement out of reach.

A wealth adviser will typically work with the client to understand their risk profile and put together an investment plan specific to their needs by making sure they have appropriate allocations to various asset classes, such as domestic and international shares, property, bonds and cash, to make sure they have sufficient growth while containing the volatility of returns within the individual’s comfort zone.

Investors with shorter time horizons, lower risk tolerance and preference for income-generating assets will typically be more suited to portfolios with a greater weighting toward cash and fixed interest.

Investors with longer time horizons, greater risk tolerance and less requirement for near-term access to portfolio cash flows will be more inclined toward shares and property. Of course, advisers should update and change the client’s investment profile and move toward more growth or stable assets as situations change and depending on where the client is in the life cycle.

Once asset allocation has been determined, the next step is security selection, which based on empirical evidence and AssureInvest’s own experience, should be focused on fundamental high quality and value. Individuals are increasingly seeking direct investments over managed funds because of the preference for transparency and control.

Once portfolio design is complete, implementation should be made via the cheapest and most efficient means possible in order to further boost total investor returns.

Accountant opportunity: many clients also seek guidance on wealth creation

Many accountants see the exciting opportunities to grow revenues and boost client satisfaction by broadening their scope of advice to clients.

Individuals usually see their accountant to sign off on their tax statements each year. This face-to-face engagement offers accountants opportunities to discuss other ways they can support the client’s financial situation. Accountants already have in-depth knowledge of the client’s financial and other personal affairs and are well positioned to help them make the best decisions for their future. Many people prefer to have just one holistically minded professional helping with their finances, rather than a raft of specialists.

Accountants regularly come up in surveys as the most trusted adviser among clients receiving some form of financial advice (including CoreData’s April 2014 survey, “Pathways to Success with SMSFs”).

Trust is typically hard won, built upon a long record of integrity, putting the client’s interest first and demonstrating a genuine concern for the client’s wellbeing. Greater trust means individuals are likely to remain clients for longer, develop deeper relationships, ask for more involvement in their personal and financial affairs, be more satisfied with the service they receive and pay higher fees.

According to CoreData, most people who receive some form of advice choose their accountant as their primary source of advice on money matters. When it comes to SMSF advice, this market positioning is even stronger. Accountants administer more SMSFs than any other agency, while more people go to accountants to find information relevant to SMSFs than any other source.

Continued SMSF growth provides strong tailwind for advice demand

Strong growth in SMSFs is attracting more attention from planners and accountants. CoreData’s 2014 “SMSF Professionals Study” showed SMSF advisers expect more than 10 per cent growth in revenue from SMSFs in the next three years. A number of outsourcing services help accountants service these customers more efficiently.

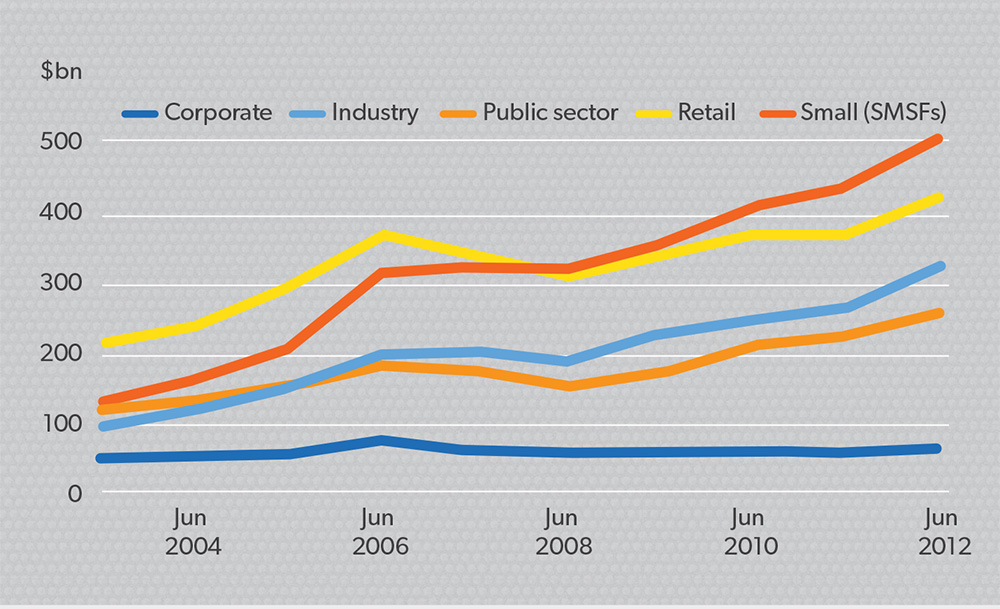

The number of SMSFs grew by 7.1 per cent to 509,000 in 2013 and has averaged 7.3 per cent growth each year over the past decade. Above-system growth appears set for some time due to investor attraction to greater control, lower cost, better performance and the ability to borrow within the fund (see Figure 2).

Figure 2

New regulations give accountants options to expand services

Accountants have three main options to be a trusted party for their clients’ financial advice, each with different licensing implications.

Offer a trusted referral service with financial advisers licensed to provide personal financial product advice.

Provide a trusted one-stop shop with in-house financial advisers.

Partner with an outsourced investment manager to provide trusted specialist tailored investment guidance for the accountant’s clients.

The new limited Australian financial services licence (AFSL) broadens the scope of advice accountants can give beyond setting up and closing SMSF structures.

Anyone providing personal financial product advice in Australia as part of their financial services business requires an AFSL or to be appointed as an authorised representative as per chapter 7 of the Corporations Act. Under the accountants’ exemption, accountants have been able to provide personal product advice on the establishment of SMSFs, without the need for an AFSL. This exemption will cease in June 2016, so many SMSF accountants are looking to obtain their own AFSL or merge with or become an authorised representative of an existing licensee.

To help accountants move into the AFSL regime, the government amended the Corporations Regulations 2001 to create the new limited AFSL in 2013. Transitioning is more streamlined for accountants applying for a limited licence before July 2016.

The limited licence means accountants can provide general advice without the need for a full AFSL. A number of accountants will regard the limited AFSL as a valuable stepping stone to becoming one of a new breed of accountant wealth managers – licensed to provide more holistic wealth management services. The limited AFSL arrangements don’t allow accountants to provide full financial planning services, but clearly allow the accounting and financial planning professions to draw nearer.

A limited licensee can be authorised to give advice about establishing and managing SMSFs, superannuation holdings in certain circumstances and ‘class-of-product’ advice about a range of products. Class-of-product advice means, for example, accountants may recommend to a client that bank deposits, shares and bonds are appropriate for them, but they cannot recommend which particular bank deposit or security to choose. Limited licensees can choose to be authorised to give class-of-product advice about the following financial products: superannuation, securities, general insurance, life risk insurance, basic deposit products and simple managed investment schemes (as defined in the Corporations Regulations 2001).

A limited licensee can also be authorised to arrange to deal in an interest in an SMSF, including applying for, acquiring, varying, issuing or disposing of financial products on behalf of a client.

Limited licensees will, of course, need to meet conduct and disclosure obligations and other requirements of the Corporations Act, including complying with the best interests duty and providing clients with a statement of advice, where required. General licensing obligations are covered in section 912A of the Corporations Act.

Accountants without a limited or full AFSL will not be able to provide financial services advice after the accountants’ exemption is removed on 1 July 2016.

Training and other support

A number of training organisations provide education pathways to support accountants in satisfying the organisational competency requirements of AFSL responsible managers and the Regulatory Guide 146 training requirements for those giving financial product advice to retail clients.

For some, becoming an authorised representative under an existing AFSL will be their preferred option, where they have found a licensee that provides the appropriate level of independence, support and resources, and an approved product list that matches the services they want to provide.

Helpful information on accountant licensing requirements can be found on the Australian Securities and Investments Commission’s website and those for industry bodies such as CPA Australia, Chartered Accountants Australia and New Zealand and the Institute of Public Accountants.