Matthew Esler puts forward a case for outsourcing the preparation of compliance documentation.

Financial advisers are in the business of providing financial advice. Their role is to understand the needs and objectives of their clients, and provide strategy and product advice recommendations that aligns to those needs and objectives. Financial advice is what they are authorised, licensed, trained and experienced in doing. However, onerous legislation, regulation and compliance requirements often prevent advisers from performing this most important role. Laboured by the burden of administrative red tape, financial advisers, and their support staff for that matter, are unable to provide financial advice efficiently, and their practice and profitability suffer as a result.

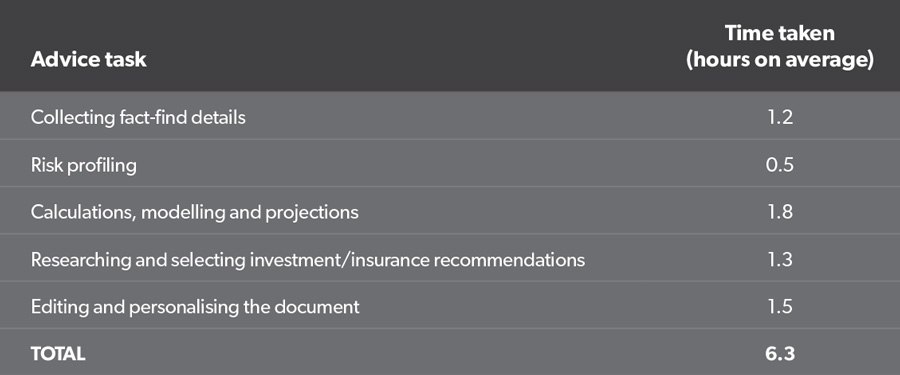

According to the “Investment Trends 2016 Planner Technology Survey”, it takes 6.3 hours on average to produce a statement of advice (SOA). In other words, it takes a full day to produce advice for one client. While this sounds ridiculous, not least because it is near impossible to run a profitable business with such a drag on primary production, in my opinion it actually takes even longer. The survey is subjective and financial advisers are an optimistic bunch.

Investment Trends looked at the average time taken to perform five key tasks required to produce an SOA. Interestingly, despite significant advances in technology over the past decade, the average time taken to produce an SOA has barely moved the dial. (See Table 1)

Table 1: Statement of advice – average time to produce

Of the five tasks, the one that has reduced most significantly over the past decade is editing and personalising the document – something the financial planning software providers can hardly take credit for. Financial advisers in Australia reportedly have an average age in the mid-50s and, according to a recent Cerulli Associates report, in the United States it’s slightly lower at 50.9. In any case, financial advisers of any age should not be spending 6.3 hours in front of a computer each time they would like to produce an SOA for one of their clients. Unfortunately many advisers do.

When it comes to advice generation, there are generally three types of advisers:

Do-it-yourself (DIY) advisers – advisers who produce their own SOAs.

Insource advisers – advisers who have internal staff, such as paraplanners or administration staff, to support them in producing the SOA. Outsource advisers – advisers who arrange for professional paraplanning firms to produce the SOA on their behalf.The following case studies analyse the impact and financial position of producing SOAs yourself, insourcing to a paraplanner or other support staff, or seeking external support from an outsourced paraplanning firm.

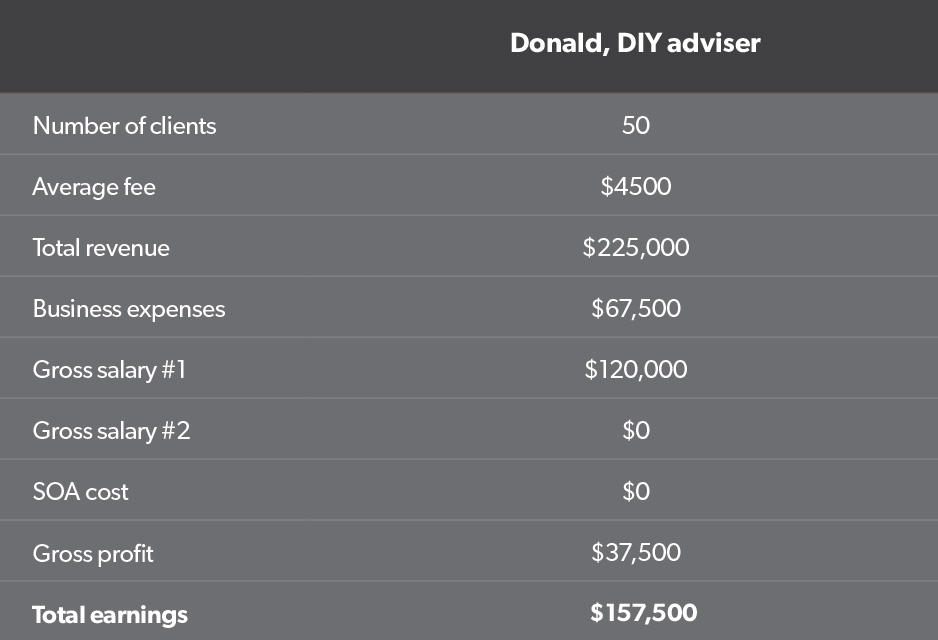

Case study 1 – Donald the DIY adviser

Donald is a DIY adviser. He likes to produce SOAs himself because he doesn’t have anyone else to support him and he is the greatest. In Donald’s words: “I’m very comfortable doing it myself because I know I do a great job, just great.” Donald’s practice generates $225,000 from his book of 50 clients (at an average of $4500 a year). His business expenses are about 30 per cent of his revenue, or $67,500. He is drawing an annual gross salary of $120,000 from his business. His practice’s financial position is as follows in Table 2.

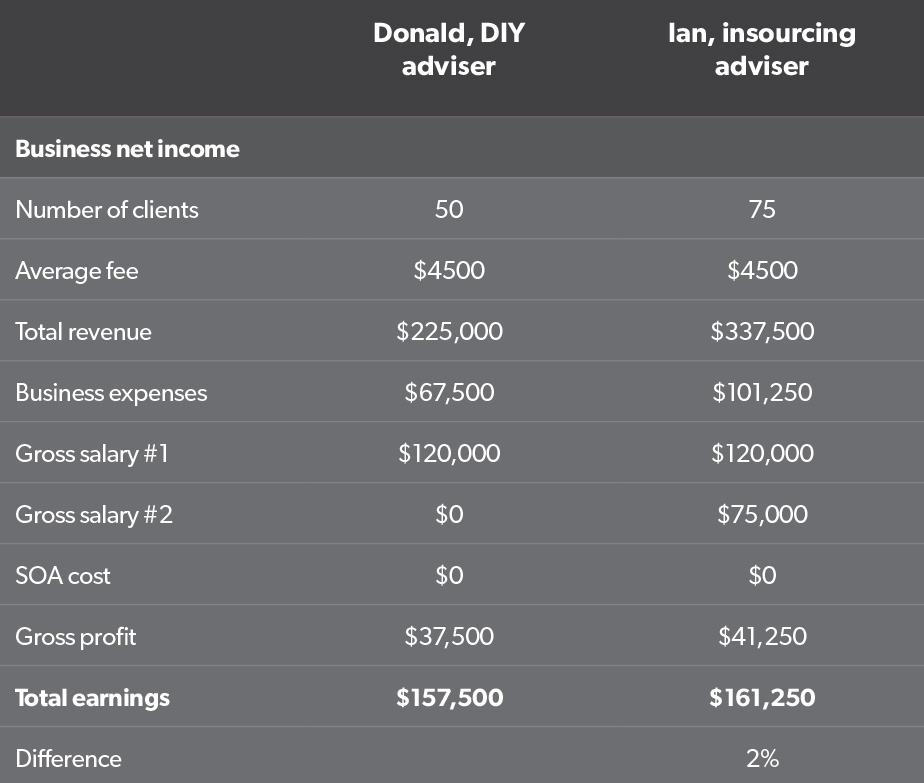

Case study 2 – Ian the insourcing adviser

Ian, like Donald, had 50 clients. However, in an attempt to reduce administration and increase the net income, Ian decides to employ Sarah, a paraplanner with less than three years’ experience, to assist with client service and business administration, including paraplanning. By hiring Sarah, Ian moved from being a DIY adviser to an insourcing adviser. This enabled Ian to increase the number of clients he is able to service by 50 per cent (that is, from 50 to 75). However, by hiring Sarah, Ian has increased the business costs by her salary of $75,000, which is pretty standard for a paraplanner with at least three years’ experience, plus super guarantee (SG) contributions of 9.5 per cent plus oncosts. The difference between Donald’s situation and that of Ian are contained in Table 3.As illustrated in Table 3, there is only a slight increase in total earnings moving from DIY to insourcing, despite a 50 per cent increase in the number of clients, from 50 under the DIY approach to 75 under the insourcing approach. Also, the 2 per cent increase in total earnings or $3750 hardly covers the additional risks involved. For example, if Ian had not achieved the 50 per cent increase in clients, let’s say he only got to increase his client numbers to 70, he would have experienced a decrease in total earnings. Also, if Sarah had cost more than $75,000, this would have a negative impact on Ian’s net income outcome.

Table 2: Financial positions for DIY advisers

Table 3: Financial positions for DIY v insourcing adviser

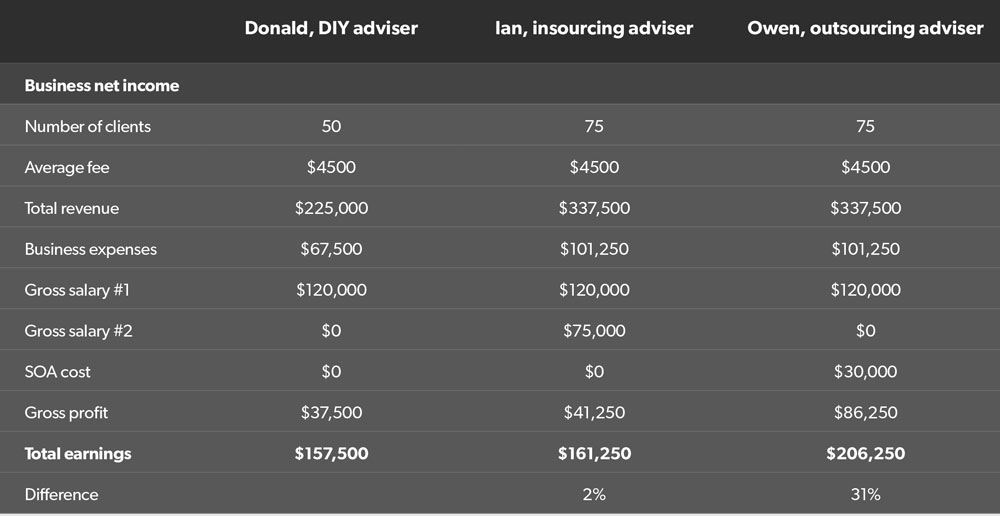

Case study 3 – Owen the outsourcing adviser

Owen was in the same position as Donald and Ian. With 50 clients, Owen decided to outsource his paraplanning to an external service provider. The move allowed him to make advice requests more efficiently and meant the time he was taking to produce SOAs for clients went from 6.3 hours on average to less than 30 minutes. Owen used the spare time he created to increase his client numbers by 50 per cent, again from 50 to 75. This is the same number as Ian was able to achieve with an insourced resource, however, instead of paying a fixed cost in the form of a full-time salary plus SG contributions, plus oncosts, Owen pays a yearly fee of $30,000 for advice document costs. For this example we have assumed the additional 25 new clients require SOAs and the existing 50 clients require records of advice (ROA) (given they would have previously received SOAs). This has been calculated as $300 on average for the ROAs and $600 on average for the SOAs (or 50 x $300 + 25 x $600 = $30,000). (See Table 4.)By outsourcing SOA and ROA production, he is able to generate significantly more total earnings than both the DIY ($48,750 better off) or insourcing approaches ($45,000 better off).

Table 4: Financial positions for DIY v insourcing v outsourcing advisers

The additional income and profitability Owen is able to generate is remarkable, however, very few advisers follow a completely outsourced paraplanning model. In addition to reducing the business’s fixed costs, the time involved with managing a staff member is eliminated.

Finally, it is important for financial advisers to be able to identify or differentiate a high-quality outsourced paraplanning provider from a low-quality provider. Here are some pointers for identifying high-quality outsourced paraplanning firms:

- Seek out an onshore, outsourced paraplanning business where client data or client information is not sent offshore. Offshore businesses will be cheaper on face value, however, the amount of back-and-forth due to language, communication and time differences often leads to the costs being more expensive than if you had sought out an Australian-operated business initially.

- Ensure the outsourced paraplanning provider is fully compliant with your licensee’s requirements and ensure they provide a workflow tracking tool or umbrella view for the licensee so the compliance team can monitor requests and the advice documents generated.

- Confirm the outsourced provider has sufficient technology resources to drive equality, efficiency and value.