Significant fanfare was not afforded to one feature of the 2016 federal budget that could pave the way for a better retirement income framework, writes Tim Wedd.

A 65-year-old person today is expected on average to live to 85. The question is how well?

This should be the core focus of retirement policy debate as we face a burgeoning ageing population with the associated increased funding costs. Unfortunately, the arguments still revolve around how the super system is to be taxed rather than how it will deliver an adequate, dignified retirement income to its members – for the whole of their life. This goes beyond the simple objective of providing an income in retirement “to substitute or supplement the age pension” as enunciated currently for the super system.

However, a small step in the right direction was made as part of this year’s federal budget. While it was little noticed at the time, as part of the budget the government released its response to a 2014 discussion paper about retirement income stream regulation and announced it had accepted all recommendations of the Treasury review. This addressed both the minimum withdrawal amounts for account-based pensions and the existing regulatory barriers restricting retirement product development.

The release of these findings provides a valuable insight into the measures that are now being formulated to progress the development of our retirement income system. Not surprisingly, the review confirmed the current arrangements for the drawdown of income and capital in retirement for account-based income streams should be maintained as is, but reviewed every five years.

The more interesting focus was on the subject of pooled lifetime risk-based products to address longevity issues. It confirmed as a first step the barriers to the development of new retirement income products were coming down by extending the tax exemption on earnings in the retirement phase to a range of additional products that can be offered from 1 July 2017. Essentially the measures target lifetime products that can involve immediate and/or deferral of income payments within the product design, provided they follow a set ‘capital access’ framework. This is an alternative to using the current product rules that target income stream restrictions each year.

For a lifetime income, the proposed framework uses a straight line method to calculate maximum capital access values based on life expectancy from the time of purchase. In other words, the capital available on commutation declines each year by the same percentage amount with the exception of death benefits. For the first half of a person’s life expectancy (measured at purchase), the maximum commutation value upon death will be up to 100 per cent of the purchase price.

For deferred lifetime annuities (that is, ones purchased with a deferred income start date), the capital access schedule will be the same and set also at the time the product is purchased. This means it is quite possible that by the time the actual income payment starts there is effectively no capital value available anymore.

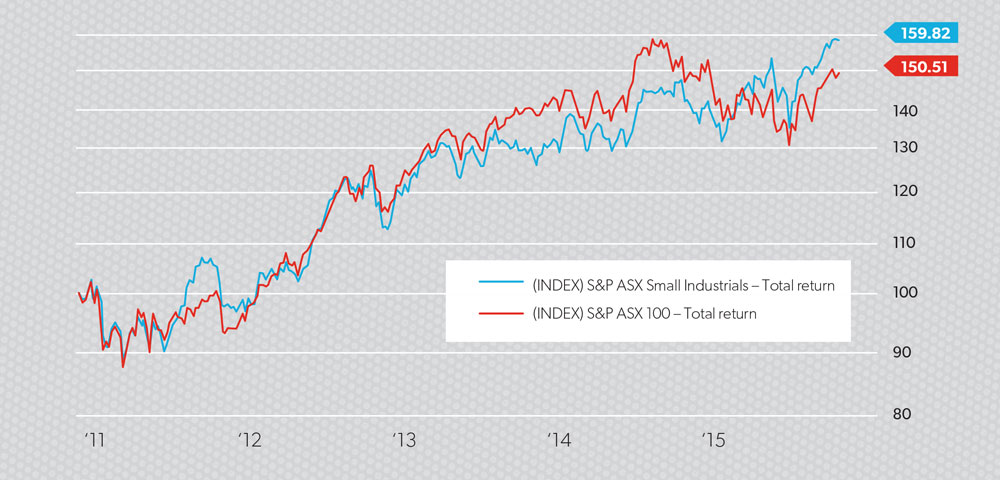

Figure 1: Product purchase by a male aged 65

Figure 1 illustrates the potential maximum ‘capital’ value available from a lifetime product built under the new proposed framework, assuming a purchase at age 65 for a male investor.

The following key design features were outlined within the review:

- An additional set of income stream rules should be developed, which would allow lifetime products to qualify for the earnings tax exemption.

- The rules should be in addition and an alternative to the existing minimum drawdown payment rules for non-account based products.

- The alternative product rules should accommodate purchase via multiple premiums, provided no income payment has commenced.

- SMSFs and small Australian Prudential Regulation Authority-regulated funds should not be eligible to offer these new products (although they could purchase such products).

Removing the tax barriers to product development is only one part of creating more flexibility in our retirement income system. There is still much detail to be worked through, including the important social security means testing framework – even more important given the last round of changes to aged-care assessment. However, the framework now canvasses the ability to purchase future retirement incomes through multiple premiums, which should allow such deferred income promises to be set at a wide range of ages. This will assist to spread both funding cost and interest rate risk.

Unfortunately, the new lifetime retirement income products are not recommended to be able to be offered by SMSFs directly, given the lack of risk pooling available at a small fund level. However, these funds will be able to purchase the new products once developed as part of the SMSF asset mix. This raises the opportunity for SMSFs to purchase a form of longevity insurance to underwrite the rest of the investment plan within the fund.

Perhaps the most interesting part of the review’s findings is the ability to purchase deferred income streams prior to retirement (that is, in accumulation phase). Deferred retirement incomes that address longevity risk can be established early at a fraction of the capital cost that a comparable immediate annuity requires, given the extended funding time frame. Setting aside a lower amount of capital by starting earlier to fund a future promise also means a lower amount of capital is subject to access restrictions. Depending on the product solutions developed by insurers, this may allow for a range of staggered lifetime payments to be struck at different ages, each subject to a separate capital access framework and income promise. Accordingly, while no capital value would ever be ascribed to them in practice by the time the income is required (for example, typically age 80-plus), a member could build a ‘stepped’ longevity promise gradually and with a lower capital commitment.

Such facilities may allow SMSF members to carry more volatility risk early into their retirement as they know there will be a future reserve to cover running out of money too early. This improves the ability to manage drawdown risk at different stages of retirement (that is, not being a forced seller of assets at the wrong time). SMSFs can offer clients a seamless structure within which to manage both the accumulation and drawdown stages of retirement for a range of members. This means potentially under the new rules they may offer ‘hybrid’ retirement income solutions as part of their total member solutions to address longevity concerns.

There is always the risk here that these measures won’t be passed by the new parliament, however, hopefully this measure receives bipartisan support given the recommendations stem from the final report of the Financial System Inquiry and subsequent Treasury analysis. In any event, 1 July 2017 (a decade on) is shaping as another key milestone in the evolution of our retirement system. While undoubtedly there will be further wrangling on contributions, pension or earnings caps before then, watch out for the new product rules developing in the background.

It will certainly be of interest to our clients.