It is easy to assume an SMSF would not be applicable for the majority of Australians falling into the generation Y demographic. Grant Abbott dispels this commonly-held view.

We have all heard a lot about generation Y – those people born between 1982 and 2000. Some of the discussion is flattering, and some not so. One thing for certain is that there are 5.6 million gen Ys and for the most part their parents are baby boomers or late generation Xers. Currently the leading edge of generation Y are aged 30 – having made it through their twenties with the bulk in the first years of their multi-stage career, still at university or in the final stages of schooling. Some are married – many are not; some have children – many don’t; some have a house – many rent, share accommodation or live with their parents; some invest in shares or property. But thanks to the super guarantee, many generation Y casual, part-time and full-time workers have superannuation and in many cases reasonable amounts. It is this last connection with super that will shape the financial future in Australia as generation Ys assert their will over their superannuation for the next 50 years.

Social comments on generation Y

Australian demographer and KPMG partner Bernard Salt last year made some of the following social comments about generation Y.

“The metrics that surround the formative years of the life cycle changed undeniably between the ‘60s, when boomers were kids, and the ‘90s, when generation Ys were the same age.

“Baby boomers were reared by frugal, even austere, parents who ‘touched’ the Depression, who endured wartime rationing and who reared large families. The oft-forgotten Xers, on the other hand, had the misfortune to spill into the workforce in the early ‘90s amid tough times, and were quickly weighed down with new financial impositions such as HECS debt and rising house prices.

“In comparison, generation Y never understood concepts such as hand-me-down clothes, waiting your turn or, indeed, making their way within a judgmental, unwelcoming workforce.

“Generation Y even found a solution to rising house prices: they stayed at home with mum and dad well into their 20s. On reflection, what may be fairly said that is distinctive and positive about generation Y is that generally they are highly educated, articulate, self-confident and unfettered and global in their thinking.

“All that support by doting parents, all that esteem-building by well-meaning teachers, all that understanding by desperate employers, all that forgiveness by tetchy older workers may well have created a generation that is creative, lateral and opportunistic, but is it possible that such indulgences also may have engendered a false sense of security?

“This is the dangerous thinking that young people can be reckless in their personal lives (through alcohol and drug abuse) and in their professional dealings because unwittingly they assume there will always be a safety net supporting their choices.

“Head off to London? No worries. If it doesn’t work out there’s always a room at mum and dad’s.

“Quit your job to set up a web-based venture? No worries. If it doesn’t work out, there’s no mortgage or house or children to support.

“These options were not available to preceding generations but they are to generation Y.

“Critics see these freedoms and choices as fecklessness and for some this may be.

“But for an entrepreneurial few, such freedoms may just yield new pathways, new relationships, new businesses that would never have crystallised without the advent and adulation of generation Y.

Investor comments on generation Y

The book, Generation X and Generation Y Investors are the Future of Your Business, which provides an excellent guide for financial services professionals on how to target these significant demographic groups, noted in relation to generation Y:

“Beyond earnings potential, this generation also is poised to inherit significant assets from their boomer parents. For this reason, investment professionals should take the initiative to bring parent and child together sooner rather than later. This could be as simple as asking the boomer client for a small family meeting to discuss life insurance and estate planning strategies at a high level. By breaking the ice in a less stressful time, the investment professional creates a positive link with the generation Y prospect that may be enormously valuable if untimely death of the parent should occur.

“Generation Y investors have several characteristics that make them both attractive and challenging as clients. First, these investors live and breathe the Internet. For most it is the primary means through which they interact with others, gather information and conduct business. According to a Pew Foundation study, three-quarters of generation Y members have created a profile on a social networking site and nearly as many have posted a video of themselves online. Not surprisingly, these investors quickly adapt to online calculators and tools and show a particular affinity for visual displays of their financial choices and holdings.

“These investors appear to be welcoming of professional financial advice more readily than their generation X counterparts. The Sullivan Study indicated that 54 per cent of investors aged 25 to 34 with greater than $100,000 in assets already fall in the ‘validators’ category. Still, they might assume that they represent ‘small fish’ to investment professionals and thus must rely on their own skills, even when faced with sometimes dauntingly complex products and options. They may have this impression even if their income and assets are indeed at a level where an investment professional would be interested in taking them on as clients.

“A strong self-reliance, when combined with a high level of comfort with social networking tools, has made generation Y investors less concerned with privacy and more open to sharing their strategies. Many are very interested in what investors ‘like them’ are doing, perhaps as a means to reassure themselves of the correctness of their solo efforts.

Superannuation statistics – generation Y

Generation Y are the lucky super generation, in that they will spend a large amount of their paid employment under the superannuation guarantee scheme, which is set to continue to grow in size and more importantly as a percentage of salary and wage contributions. In addition, in many generation Y couples both adults will be working, which will result in an increase in family superannuation balances as opposed to similar baby boomer couples where one partner stayed at home in their early years to rear their generation Y children.

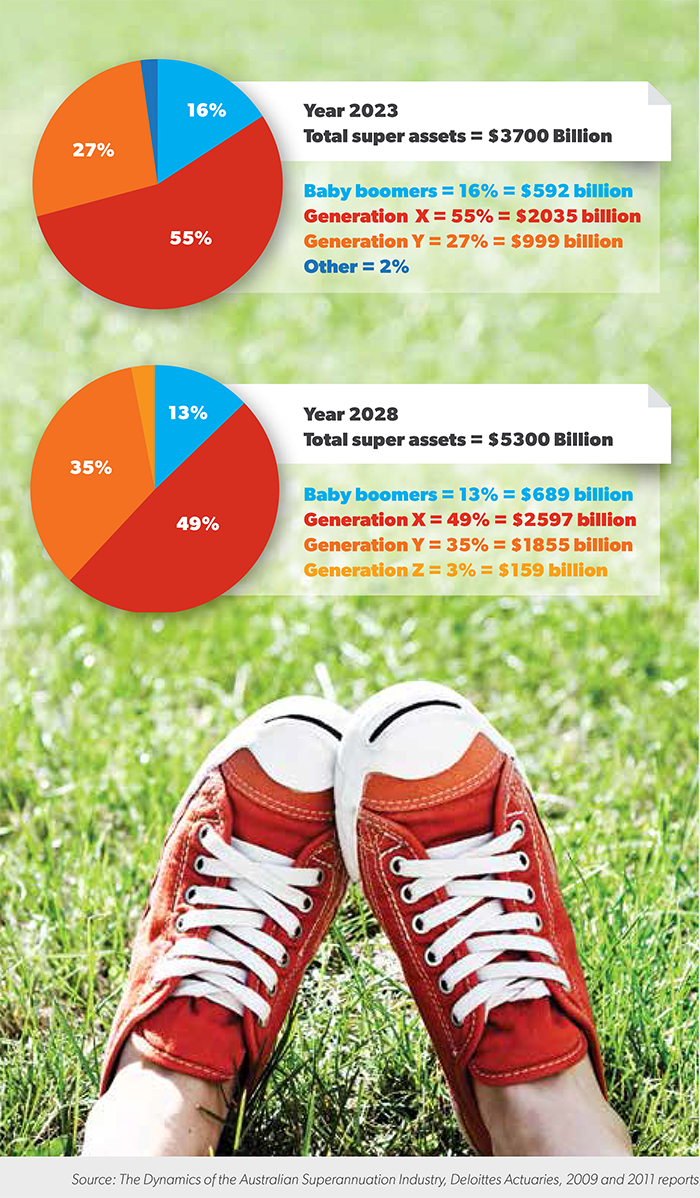

In diagram one, total superannuation assets by demographic representation are shown – both in percentage terms 10 and 15 years out with the expected size of assets at that time. It is important to note that by 2028 – 15 years from now – total superannuation assets will be dominated by generation X, however, generation Y is gradually creeping up on them in terms of accumulation as opposed to retirement assets (which will still be dominated by baby boomers).

Diagram one: Superannuation assets by year

Five SMSF strategies for generation Y

Generation Ys are not a significant component in absolute dollar terms in the current superannuation market, however, they are a large part of the superannuation guarantee pipeline that makes its way into the industry and retail superannuation funds on a monthly or quarterly basis. With the potential of baby boomer parent superannuation death benefits falling into generation Y’s hands 15-plus years on, there is a great double flow into super – provided of course superannuation retains its favoured taxation status.

In terms of SMSFs, here are some of my favourite strategies:

1. Join the parents’ SMSF

For a number of years the concept of the family super fund has been raised by serious SMSF advisers and to a lesser extent trustees. The thorny issue of an SMSF not allowing more than four members into the fund has added a difficult complexion where families have more than two children. But notwithstanding this discussion on family super funds, only 8 per cent of the population of 480,000-plus SMSFs hold more than two members. The dream of the family super fund appears a long way off despite the significant benefits:

As Salt noted earlier, generation Ys like to move around in the workforce, meaning there are many lost superannuation accounts where a default super fund has been chosen to funnel the employee’s superannuation into. With a continuing family super fund (that is an SMSF) to contribute to under superannuation choice arrangements – provided the young employee notified their payroll of the family super fund’s details and compliance certificate – lost super would not arise.

Reduced costs – many gen Ys are in low-cost industry funds, however, where the senior members of the family SMSF absorb and wear the fund’s administration costs, the fund turns into a nil administration fund for the younger generation.

Funded insurance benefits – many of those senior trustees and members that have taken the opportunity of bringing younger family members into the fund have also taken out life and disability insurance in the fund for the benefit of the younger member. Often this is paid for by the trustee of the fund directly. With the trustee of a fund having to include an insurance strategy as part of the fund’s investment strategy, this further draws attention to the need for insurances, particularly for generation Y members of the fund.

Like any financial product, it is important to discuss the benefits and disadvantages of a younger family member entering a family super fund, particularly around the control of investment, fund operational issues and for the senior members what happens in the event of divorce of younger family members.

2. Use of imputation credits for contributions tax

According to the Investment Trends April 2012 Self Managed Super Fund: Investor Report, the average annual contribution made on behalf of a generation Y employee for the period to April 2012 was $19,000. On this amount generally $2850 of contributions tax would be deducted by the trustee of any non-SMSF that the employee belonged to. In contrast, the generation Y employee can benefit in a family SMSF from available imputation credits in the fund reducing the contributions tax liability. This may come from senior members’ share assets in the fund or from the direct investment by the generation Y member into shares or managed funds paying imputation credits.

3. Investment education

It goes without saying that the position of trustee – a requirement for any generation Y

member above 18 years of age – comes with responsibility. The engagement process inherent in an SMSF serves generation Y well – it is an opportunity to learn about investment, managing a growing portfolio and being mentored and coached by advisers and senior members of the SMSF.

4. Estate and incapacity planning

In the Pershing Report, one of the advising opportunities recommended is to engage with senior members of the family and their children in order to lay down estate planning criteria and plans. In this way a soft lead into the younger generations is established. With an SMSF this is a must, rather than a soft lead, and all trustees including Generation Y trustees need to be on top of members’ estate planning and who will take control and run the fund in the event of a senior member or two dying or losing their mental capacity. Delivering a carefully considered SMSF estate and incapacity plan is crucial for the success of any family SMSF.

5. Anti-detriment benefits

Anti-detriment benefit payments from all types of superannuation funds are in vogue at the moment and there is plenty of literature on the calculation and payment of these benefits with or without concessional contribution taxes. However, the real benefit is for the next generation, including generation Y members in the fund. For example, if a senior member of a family SMSF dies with $500,000 in taxable benefits, the trustee of the fund could pay an anti-detriment payment of $88,235, resulting in a tax deduction to the fund of $588,235, which if unused in the income year would become a carry forward tax loss. This would ensure the generation Y and other younger members of the SMSF have a contributions tax and accumulation tax holiday for some years to come.

These are just some of the strategies for generation Y – a long forgotten afterthought but an important cog in the SMSF wheel, both for the adviser to the fund and also the senior members of the fund.