In the second part of this two-part series, Grant Abbott identifies the individual ingredients needed to construct a successful SMSF advisory business.

I remember visiting Michael Gerber of E-Myth fame at his offices in San Diego in 1999, interviewing him and preparing him for his keynote presentation at the FPA conference that year. His words and subsequent presentation are still clear in my mind today. In terms of SMSFs, there are many planners and accountants working in SMSFs and not on their SMSF business. There is a big difference and that has influenced how I developed the SMSF business model.

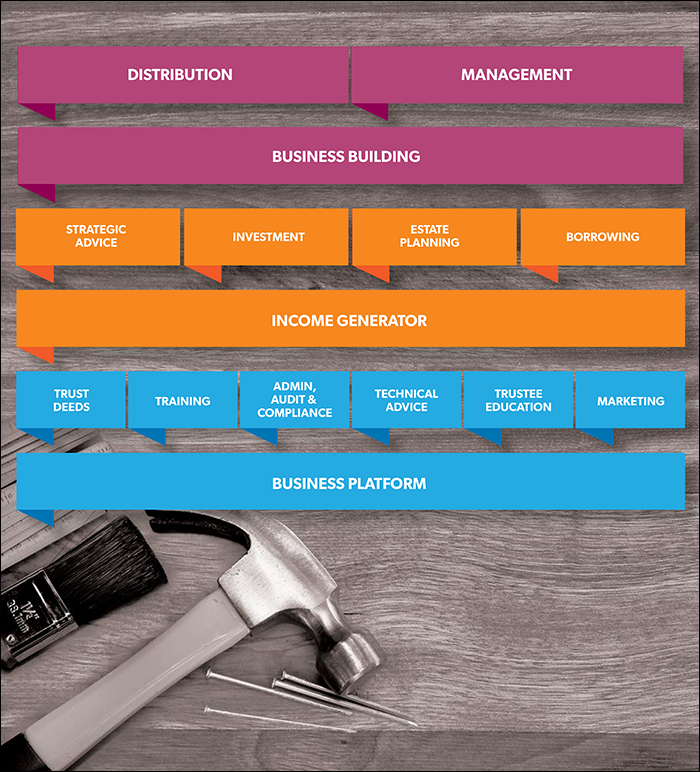

Figure one is the model I designed in 1999 following my discussions with Gerber and from years of observing accounting and financial planning businesses that developed a successful SMSF business or division. It is also a high-end business model generating strong revenues that is not reliant on investment advice, as many advisers have found is not the best way to gain and retain SMSF clients.

My experience has identified that for an SMSF business to be successful and to grow to its full potential, it must have the following key ingredients.

Business platform

The business platform is a must have for any successful SMSF business. Some or all of the services in the business platform stage may be outsourced, but to be effective they must all be in there. Most accountants and planners dealing with client SMSFs have implemented measures to some degree or have limited their platform to providing administration and deeds only. Let’s consider each element crucial to the success of the SMSF business in the long term:

Trust deeds and compliance documents

How important is the trust deed? Surprisingly, it is the foundation that holds the SMSF together. If a client is using a deed written in 2004, then they are limited by the laws of nine years ago. No transition-to-retirement income stream, no account-based pension, no creation of separate super interests, no SMSF wills, no borrowing, and the list goes on. An old deed can’t access law changes made after the deed’s execution due to trust law and the Superannuation Industry (Supervision) (SIS) Act 1993, specifically section 55(1), which provides neither the trustee, nor anyone else for that matter, can breach any of the rules of the trust deed.

SMSF law is continually changing and with these changes the underlying platform for a strong, secure SMSF, being the trust deed, must not only be in touch, but move in line with those changes. This is recognised by the commissioner of taxation, who requires new trustees to declare that they will ensure that “the fund’s trust deed and investment strategy are regularly reviewed and updated in accordance with the law and the needs of the members”.

At worst a trust deed should be upgraded every three years and at best annually as part of the SMSF package offered to clients. It is also crucial to ensure all documentation to support any strategy or transaction is completed and meets audit, Australian Taxation Office (ATO) and legal requirements. Over the past four years we have witnessed a vast number of mistakes being picked up by in-house or external lawyers to SMSF lenders, who review deeds and documentation prior to signing off on a limited recourse borrowing arrangement (LRBA). These mistakes require clunky deeds of rectification or deeds of ratification. Some of the typical mistakes made are:

- deeds are not executed,

- variation of deeds not complying with the process in the original deed, such as the requirement of a principal employer or appointor to execute any deed of variation,

- holding trusts are in the SMSF trustee’s name, and

- conveyancing solicitors are documenting the transfer of a property to a super fund, then to transfer to an LRBA.

Compliance can only be achieved at best through regular quality training, interaction with other accountants and SMSF advisers on specific client matters and being able to receive practical, strategic advice.

Administration and audit

Administration has long been the backbone of an accountant’s SMSF business, as has audit. However, with the increasing requirement to split administration and audit functions, audit and administration specialists are coming to the fore, particularly after the release of lengthy SMSF audit standards and auditor registration. For administrators, programs such as BGL offer strong SMSF software and have stood the test of time, but are being impacted on by Class Super and superMate, which are more cloud-style offerings. There is also significant pressure on administration fees as more outsourcing firms compete for space and drive down administration fees.

Training

The more an accountant or planner invests in SMSF knowledge, the greater the reward for the client and also for the practitioner’s career and business opportunity. The majority of accountants and planners understand the general concepts of super, such as pensions, lump sums, tax-free and taxable components, segregating assets of a fund for tax exemption purposes and making contributions to a fund. However, moving in a line from broad knowledge to specific knowledge opens up strategic opportunities that can make a big difference to a client’s affairs.

One such possibility is the payment of an anti-detriment benefit by the trustee of a fund to a deceased member’s dependants or their estate. The bonus payment, sourced from a reserve of the fund, life insurance, earnings or sales of the underlying tax credit is to compensate the member’s beneficiaries for the payment of contributions tax on member contributions during their life. The actual payment, to be determined by the trustee under the audit method or by a formula allowed by the commissioner, will result in the fund obtaining a tax deduction of the compensation payment/15 per cent. For example, if the payment was $150,000, then the tax deduction to the fund that can be used as a carry-forward loss will be $1 million, thereby earning the next generation of members a long tax and contributions tax holiday in the fund. This strategy is a given in retail super funds, but rarely used in an SMSF due to the lack of knowledge of the death benefit bonus and how to use the strategy.

Training in SMSFs needs to be:

- firm-wide to enable succession in this growth area of advising,

- variable from high-end technical strategies for partners to practical implementation for administration staff,

- affordable,

- meet current standards of providing advice on SMSFs or administering SMSFs or auditing them, and

- resource focused with minimal time out of the office.

Information technology

The Internet has revolutionised the way many businesses operate and SMSFs are no different. Consider the last point dealing with training: the move to portable 24/7 online training ensures minimal office disruption and lower costs all around. All areas of the economy are being rewired by technology and SMSFs are not an island.

Marketing

The first step in SMSF marketing is to define the service offering. If it is simply the provision of administration, then the offering needs to be described in simple terms in respect of price, delivery and timeliness of deliverables, among other things. But long-term administration fees are headed downward, so the use of technology and offshoring may be needed to make the administration offering viable and competitive. But looking to our specialist SMSF business or division, the market positioning needs to be more expansive as to what can be delivered to the client and how it can be delivered. If it is the full SMSF business model, then there must be a description of what an SMSF specialist business means.

Tools in the marketing armoury to position, market and sell to clients and prospects include:

- targeted email marketing,

- Facebook,

- LinkedIn,

- YouTube,

- Google, LinkedIn and You Tube advertisements,

- Twitter, and

- targeted video content providing educational material to the client.

Trust deed education

Research undertaken by CoreData on behalf of the Australian SMSF Members Association shows trustees are not seeking holistic investment advice but strategy-based advice. They are thirsty for strategic advice on how to maximise their opportunities in the fund. To that end, targeted trustee education, including DVDs, YouTube videos, emails, newsletters and other communications designed to educate and motivate the client to enquire, build and develop the strategy with their SMSF coach or trainer, is a key resource fundamental to the success of the SMSF advice business. A knowledgeable client is a lifelong trusted client.

Income generation platform

The income generator needs the business platform stage to work effectively and efficiently.

SMSF strategic advice

This is one area accountants and planners have often given away, yet it can become one of the most profitable. For example, a number of strategic advisers are offering and getting clients on board for the anti-detriment payment strategy (discussed above), charging fees of up to $5000. This includes a letter of advice, two meetings and necessary trustee minutes – a high-value strategy that benefits the client and their family as well adding profit and value to the bottom line. Some high-value strategic areas that are worthy of consideration for a strategic advice makeover include:

- restructuring from a family trust to an SMSF,

- sale of a business and SMSFs,

- running multi-SMSFs for blended families,

- bucreation of automatic multi-reversionary pensions rather than plain vanilla account-based pensions,let

- bringing the next generation of members into the fund,

- creating an anti-detriments reserve,

- LRBAs, and

- self-financing instalment warrants.

Investments

Whether investments can be added to the mix will depend on the licensing status of the firm. Without a licence there are no investments that can be recommended and even with a limited licence, only class-of-product advice can be provided. For those with a licence, a word of advice: if you get the strategic advice right, then the investment advice should match the strategic advice. This is where many financial planners get SMSFs wrong. They place investments with no regard to the underlying tactical strategy employed by the trustee and their accountant. And if things turn, it can have a dramatic impact on the technical strategy.

Estate planning

With the tax commissioner and case law stating the use of a binding nomination is no longer valid for an SMSF, the SMSF will take on the mantle of the supreme estate planning structure for all members of an SMSF.

Importantly, the SMSF will allows:

- A member to maximise the tax efficiency of their SMSF estate, leaving specific benefits to dependants, non-dependants and the legal estate.

- The executor to take your place as trustee of the fund on your death until your SMSF will is carried out.

- 3.

With SMSFs now averaging in excess of $1 million per fund, SMSF estate planning is an integral part of an accountant’s advising armoury and also an area of value-added advice for the client.

SMSF insurances

SMSF insurances are gaining traction with SMSFs that have become multi-generational funds, particularly now that an insurance strategy is required as part of the fund’s investment strategy. As younger members come into the fund, the earnings of the fund may be used to acquire life and total and permanent disability insurance for those members at a very low fee. As those younger members have children, the elder members of the fund can control the distribution of the life insurance in the event of the death of a younger member.

The value that can be added to the SMSF business here will depend on the licensing. However, a branch agreement can be developed with a suitably qualified SMSF life insurance expert so that SMSF insurances become a strong business line. A word or warning: make sure the life insurance broker knows what they are doing with SMSFs. Stick with those that specialise in SMSF insurance.

SMSF borrowing

It is estimated there will be more than 40,000 LRBAs established this calendar year and with low interest rates expect the growth to continue quickly. It is the killer app in terms of SMSF strategies and recommended fees for completing the deal for the client are between $5000 and $7000. There is plenty of competition for the lending business and with $550 billion sitting in the retail and industry super fund accounts of generation X employees, this is the main growth area for any accountant and planner to focus their business on. This leads to other strategies – insurance and estate planning.

Business builder

Building the business is crucial to the success of the SMSF advice.

Management

It goes without saying this is the glue that brings the business platform and the income generator together. However, we are not just talking about operational management, but direction, leadership and looking for opportunities in the expanding SMSF market. For many accounting partnerships and planning businesses often an SMSF management partner is chosen to run this side of the business. But there must be a desire to build the business and room to do so from other partners.

Distribution

Distribution is about forging alliances, networks, joint ventures and creating avenues of business for the firm’s SMSF services. It is how a business continues to grow. A simple measure, such as asking existing clients for referrals, is the distribution. Building business through local business brokers is another measure of distribution where the broker refers clients who are selling a business for retirement purposes to the SMSF firm. With borrowing being centre stage, team up with mortgage brokers and do joint seminars to get business rolling in.

One area of distribution may be accountants who want specialist advice and other services to add to their administration offering. Great care has to be had in structuring the business so that the accountant is not concerned there will be a loss of clients to the SMSF firm.

Figure 1: SMSF business model