David Shirlow examines the complexity of maximising superannuation contributions in a tax-effective manner when individuals turn 65.

You have several clients turning 65 this income year, each with substantial funds available to invest in super. You now face the trials and tribulations of guiding them through the tax and super rules on making contributions in a compliant and tax-efficient manner.

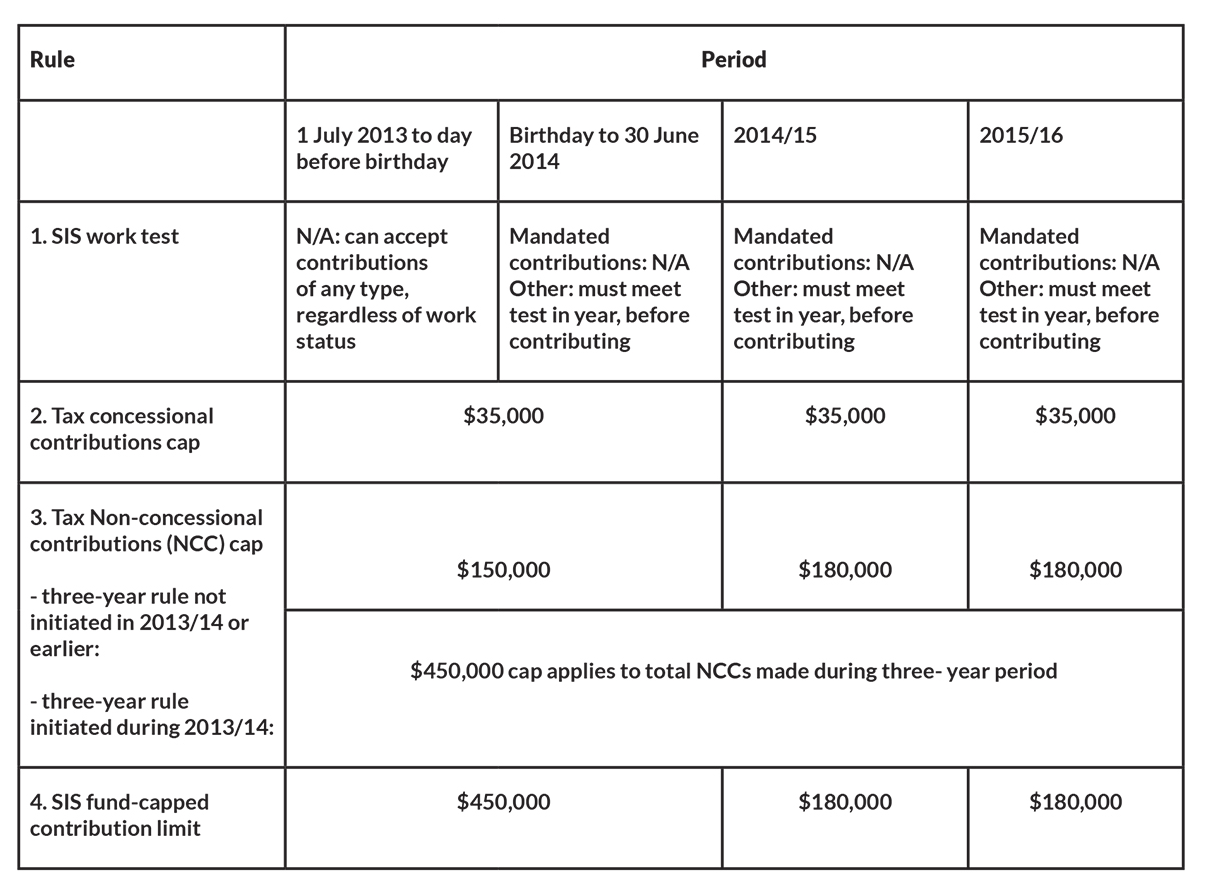

The table below is a brief overview of relevant Superannuation Industry (Supervision) (SIS) Act 1993 and Income Tax Assessment Act 1997 (ITAA) rules as they apply to a client who turns 65 in 2013/14. The rules will then be described in further detail along with how they apply in particular scenarios.

The term mandated contributions refers to contributions that are made to meet super guarantee or industrial award or certified agreement obligations. One of the key things to note about the table is that the SIS work test rule applies to non-mandated contributions as soon as the client turns 65, typically during the course of the income year, whereas the other rules are determined at the start of the relevant income year. This difference is a common source of confusion.

The other thing to note about both the table and the following discussion is that it is based on the law at the time of writing and assumes the relevant rules will not be amended so as to affect the outcomes described. It is also assumed there will be no indexation of caps in 2015/16 or 2016/17 (which seems realistic). Commentary has been limited to:

- clients turning 65 in this or next income year and the two income years after that – it does not cover the rules for clients aged 70 or over, and

- non-mandated contributions.

Meeting the SIS work test

Contributions can be made for a client prior to their 65th birthday regardless of their work status. Generally, as soon as a client turns 65 they must satisfy the work test, otherwise their superannuation fund will be unable to accept contributions for them. There is a very limited exception that relates to contributions made in relation to earlier periods typically by employers for previous periods of service. The Australian Prudential Regulation Authority (APRA) provides some guidance for APRA funds on this exception in SPG 270, which indicates it does not envisage the exception would enable trustees to accept personal contributions.

The work test requires that the client has been gainfully employed for at least 40 hours in a period of 30 consecutive days in the relevant income year.

Example

Milan – retiring and turning 65: Milan had been working full-time up until 30 April 2014, but retired from all work on that day. He turns 65 on 1 June 2014. There is no limitation on making contributions for him prior to 1 June 2014 because the work test does not apply. He can also make contributions at any time in June 2014 because he has already satisfied the work test for this year. The fact he has met the work test before turning 65 does not matter: it is sufficient that he met it in 2013/14.

But what if Milan had actually retired before the start of 2013/14 and had not worked at all this income year up until his birthday? In that case he would need to work 40 hours during June to meet the work test. Technically he would need to have worked those 40 hours before a contribution can be made for him.

The tax CC cap

For tax purposes the concessional contributions (CC) cap, which is always determined annually and applies for a whole income year, is currently $35,000 for clients aged 60 or over on the day before the relevant income year starts. It does not change at age 65.

The tax NCC cap: how the three-year rule operates after age 65, in years two and three

Unless the three-year rule applies under the ITAA, the maximum total amount of non-concessional contributions (NCC) allowed to be made in a particular income year without excess NCC tax applying is the annual NCC cap for that year. The annual NCC cap for 2013/14 is $150,000. The annual NCC cap for 2014/15 is $180,000.

The three-year rule applies if in one income year the total amount of NCCs contributed by a client exceeds the annual NCC cap and the client has not done that in either of the two previous income years. The three-year rule provides that, in these circumstances, the client’s NCC cap for that and the following two income years will be three times the annual NCC cap for that first year.

The application of this rule can only be initiated in an income year in which a client was under 65 at the start of the year. If initiated, it will apply in the following two income years regardless of the client’s age in those years.

Examples

Ravenna – turns 65 in 2013/14: Ravenna has available funds of $260,000, which she wants to contribute to super as an NCC in 2013/14. She expects substantial further funds to become available the year after next. She had worked full-time until her 65th birthday in September 2013 so she meets the work test in 2013/14. This year is her last opportunity to initiate the three-year rule and she triggers it by contributing a $260,000 NCC in June 2014. This means her overall NCC cap for the years 2013/14, 2014/15 and 2015/16 is $450,000. Subject to SIS rules, she can contribute a further $190,000 of NCCs in total in 2014/15 and 2015/16 without exceeding her cap. For example, if she contributes nothing in 2014/15 she could make a total of up to $190,000 of NCCs in 2015/16, provided she meets the SIS work test that year and, as discussed later, each contribution is within the SIS contribution limit.

Pienza – turns 65 in 2014/15: Pienza turns 65 in August 2014/15 (so the table above does not apply to him). He works full-time and expects to continue to meet the work test for many years. Over and above maximising his CCs each year, he has more than $700,000 of funds which he wants to contribute to super as NCCs. If he triggers the three-year rule in 2013/14 by contributing more than $150,000 of NCCs by 30 June, the NCC cap, which will apply to him until 30 June 2016, is $450,000. (Although the three-year rule is commonly referred to as the bring-forward rule, it is three times the first year’s annual cap and does not actually bring forward the 2014/15 and 2015/16 annual NCC caps.)

Pienza could consider contributing no more than $150,000 of NCCs in 2013/14. He could then trigger the three-year rule in 2014/15, in which case his NCC cap until 30 June 2017 would be $540,000. Assuming he meets the work test in 2014/15, he could, for example, make a single NCC of that amount in that year. The SIS contribution limit would not prevent this, as discussed later.

Sienna – in specie contributions and contribution reserving: Assume Sienna is in a similar position to Pienza, except she has $650,000 worth of real estate (rather than $700,000 of cash), which she is interested in transferring to her SMSF. She proposes to make a $650,000 NCC by way of an in specie transfer in June 2014, all of which would be allocated to her SMSF’s contribution reserve. The proposal is for the SMSF trustee to transfer $150,000 of that from the reserve and allocate it to Sienna’s account in June 2014, while allocating the balance of $500,000 (assuming no valuation change) to it in early July 2014. Her aim is to stay within the annual NCC cap in 2013/14 and trigger the three-year rule in 2014/15.

From a tax NCC cap perspective, in the National Tax Liaison Group (NTLG) superannuation technical sub-committee meeting of June 2009, the Australian Taxation Office (ATO) stated that in certain circumstances an NCC paid into a contribution reserve will count toward the tax NCC cap in the year of allocation from the reserve. This suggests the approach proposed would satisfy the NCC caps for the relevant years. (A similar approach is confirmed by the ATO in relation to CCs in Tax Determination TD 2013/22.)

However, in edition 29 of its SMSF News publication, the ATO indicated the SMSF trustee would be required (for the purpose of overcoming certain administrative limitations) to report contributions when they are made and not when they are allocated. This will mean that “affected SMSF members will be assessed incorrectly in relation to the excess contributions caps. The ATO’s administrative assumption is that contributions are always made and allocated in the same year, so affected SMSF members will need to draw the circumstances to the ATO’s attention when this assumption does not apply”. In other words, an affected member would need to object to any incorrect assessment of excess contributions tax.

While the tax reporting is an administrative inconvenience, more importantly there appears to be an insurmountable obstacle to Sienna’s proposal: in the NTLG superannuation technical sub-committee meeting of June 2012, the ATO expressed a view that indicates it would regard the approach proposed by Sienna as in breach of the SIS contribution limit. This is discussed further in the following section.

Meeting the SIS contribution limit

SIS limits the size of each single fund-capped contribution made for a client – refer to ID 2007/225. The SIS concept of fund-capped contribution is based broadly on the ITAA concept of an NCC. The concepts are not identical though and there are some traps to be wary of.

For example, the whole amount of a transfer from a foreign superannuation fund counts as a fund-capped contribution under SIS, whereas if an election has been made for the receiving fund to pay tax on part of the amount transferred, referred to as applicable fund earnings, then only the non-assessable part of the contribution will count for tax NCC cap purposes. However, we will assume fund-capped contributions are the same as NCCs in our examples.

For a client under 65 on 1 July of an income year, the limit on the amount of a single fund-capped contribution is three times the annual NCC cap for that year. For a client aged 65 or over on 1 July of an income year, the limit on the amount of a single fund-capped contribution is the same as the annual NCC cap for the relevant year.

If a particular contribution exceeds the limit, then the excess, and only the excess, must be returned by the fund trustee within 30 days of becoming aware the limit has been exceeded – refer to ATO ID 2008/90. However, SIS does not impose a limit on the total of contributions made in any year, so there is no SIS obligation (or, unfortunately, permission) to refund any excess of the total – refer to ATO ID 2007/225.

Because the SIS contribution limit applies to each contribution rather than the contributions made during a particular year or three-year period, it is not applied in the same way as the tax NCC cap. Of particular note is the application of the SIS contribution limit in years in which the client is at least aged 65 at commencement, but has previously triggered the three-year rule. It is worth revisiting some examples of this because the SIS contribution limit in a particular year may not be as high as the tax NCC cap applicable in that year.

Examples

Ravenna – turns 65 in 2013/14: We established that, under the tax NCC cap rule, Ravenna had triggered the three-year rule in 2013/14 and therefore had an NCC cap of $450,000 until 30 June 2016. Having used up $260,000 of that cap in 2013/14 and not having contributed in 2014/15, she could make NCCs totalling up to $190,000 in 2015/16, assuming she met the work test that year. However, the SIS contribution limit prevents her super fund accepting a single NCC greater than the annual NCC cap for that year, which we expect will be $180,000. She will therefore need to make at least two separate contributions in 2015/16 if she is to make full use of her NCC cap.

Pienza – turns 65 in 2014/15: We established Pienza does not turn 65 until August 2014/15. So assuming he meets the work test in 2014/15, he could, for example, make total NCCs of up to $540,000 in that year without breaching the tax NCC cap. Being the year he turns 65, his SIScontribution limit on any single NCC is also $540,000, so he can meet his objective with a single contribution. If Pienza chose to make less than $540,000 of NCCs in 2014/15 and was considering using up the remainder in the following two years, he would need to be mindful that the SIScontribution limit for those years would be the same as the annual tax NCC cap, which is expected to be $180,000.

Sienna – in specie contributions and contribution reserving: The ATO’s views, as noted in the minutes of the NTLG meeting referred to earlier, indicate Sienna’s proposal may contravene the SIScontribution rule for one or more reasons.

Firstly, the ATO takes the view that a single contribution made to a fund reserve can only be allocated at one time (that is not partly in June and partly in July, as proposed by Sienna). Secondly, if the SMSF trustee’s intention at the outset is ultimately for the in specie contribution to be allocated to a single member of the fund (which, incidentally, would seem always to be the case in a sole-member fund), then, for the purposes of the SIS contribution limit, it would be counted as a single contribution when made in June. So it appears that, in the ATO’s view, the SIS contribution rule would prevent a single in specie contribution of $650,000 being made for Sienna’s purposes.

A different result might be achieved with cash or assets that could be split into multiple payments or transfers to the fund in June, with allocations of each contribution occurring at different times. In this regard, clients contemplating contributing listed shares in specie may find the views of the ATO in ID 2012/79 instructive. In that interpretative decision, the ATO dealt with a case in which an SMSF member contributed parcels of shares in three different listed companies on the same day. The parcel of shares in each company was treated as one contribution because each of the shares within the parcel was of the same class and had identical rights attaching to them. However, each parcel comprised shares of different companies so the ATO considered there were three separate contributions.

Conclusion

For many clients, the year in which they turn 65 presents a final opportunity to put into place a strategy to inject contributions of a substantial size into superannuation. The appeal of doing so is to take advantage of the tax-favoured environment to fund their retirement incomes. However, it is important to ensure the various contribution rules of both super and tax law are carefully navigated in the process.