Receiving a death benefit pension from an SMSF is a common estate planning technique. However, Julie Steed looks at how the use of testamentary trusts can lead to more efficient and tax-effective estate planning outcomes.

The payment of a death benefit from a superannuation fund to a surviving spouse or a minor child can be very tax effective. However, there are often situations where clients have estate planning goals that are more compelling than just tax minimisation. These may include ensuring vulnerable beneficiaries are protected or that assets are available for distribution to non-tax dependants, including charities.

The use of testamentary trusts can provide estate planning certainty for clients with vulnerable beneficiaries and also allow for the tax-effective distribution of income between family members. These can be combined with a life interest trust to balance providing for dependent beneficiaries with distributing assets to other parties who are not financially dependent.

What is a testamentary trust?

A testamentary trust is a trust that is created within and by a person’s will, but does not take effect until after their death. A testamentary trust may be created using specified assets, a designated portion of an estate or the entire remaining balance of an estate. Multiple testamentary trusts may be created by the one will.

What is a testamentary life interest trust?

A testamentary life interest trust provides support to a beneficiary (such as a surviving spouse) following a client’s death for the remainder of their life. Once the beneficiary no longer needs support, the estate will be distributed according to the instructions outlined in the client’s will. These types of trusts are commonly used to provide income to a surviving spouse during the remainder of their lifetime, with the assets passing to the children upon the spouse’s death. They are particularly popular for clients with blended families or second marriages or families with difficult relationships.

What are the advantages of a testamentary trust?

There are a number of advantages of creating a testamentary trust, including:

- flexibility for the primary beneficiary,

- protection of beneficiaries,

- protection of assets, and

- taxation advantages.

Flexibility for the primary beneficiary

If included within the terms of the trust, the trustee can exercise discretion as to the distribution of income to beneficiaries at any time and in any proportion. There may be tax planning reasons for the primary beneficiary to request the allocation of income to a number of beneficiaries or the primary beneficiary may simply not require as much financial support as the client has allowed in their will.

If the primary beneficiary has no need for the trust, it can be wound up at any time and the trust capital will be distributed in accordance with the instructions in the client’s will.

Protection of beneficiaries

Many parents appreciate the tax efficiency of paying death benefit pensions to minor children, but balance this with their fear of what their 18-year-old may do with a large sum of money – a death benefit income stream can generally be commuted at age 18.

In an SMSF, this may be addressed by using a trust deed clause that restricts the commutation to age 25. However, this is not an option in many SMSF deeds, nor is it an option in public offer funds.

Directing some or all of the super balance to a testamentary trust can address this issue as the parents can control when children have access to funds.

In addition to minor beneficiaries, many clients will have other beneficiaries who will benefit from not having direct control over an inheritance. These can include spendthrift beneficiaries, those with gambling, alcohol or drug addictions, or people who are easily influenced by others.

Case study – Stephen and Isobel

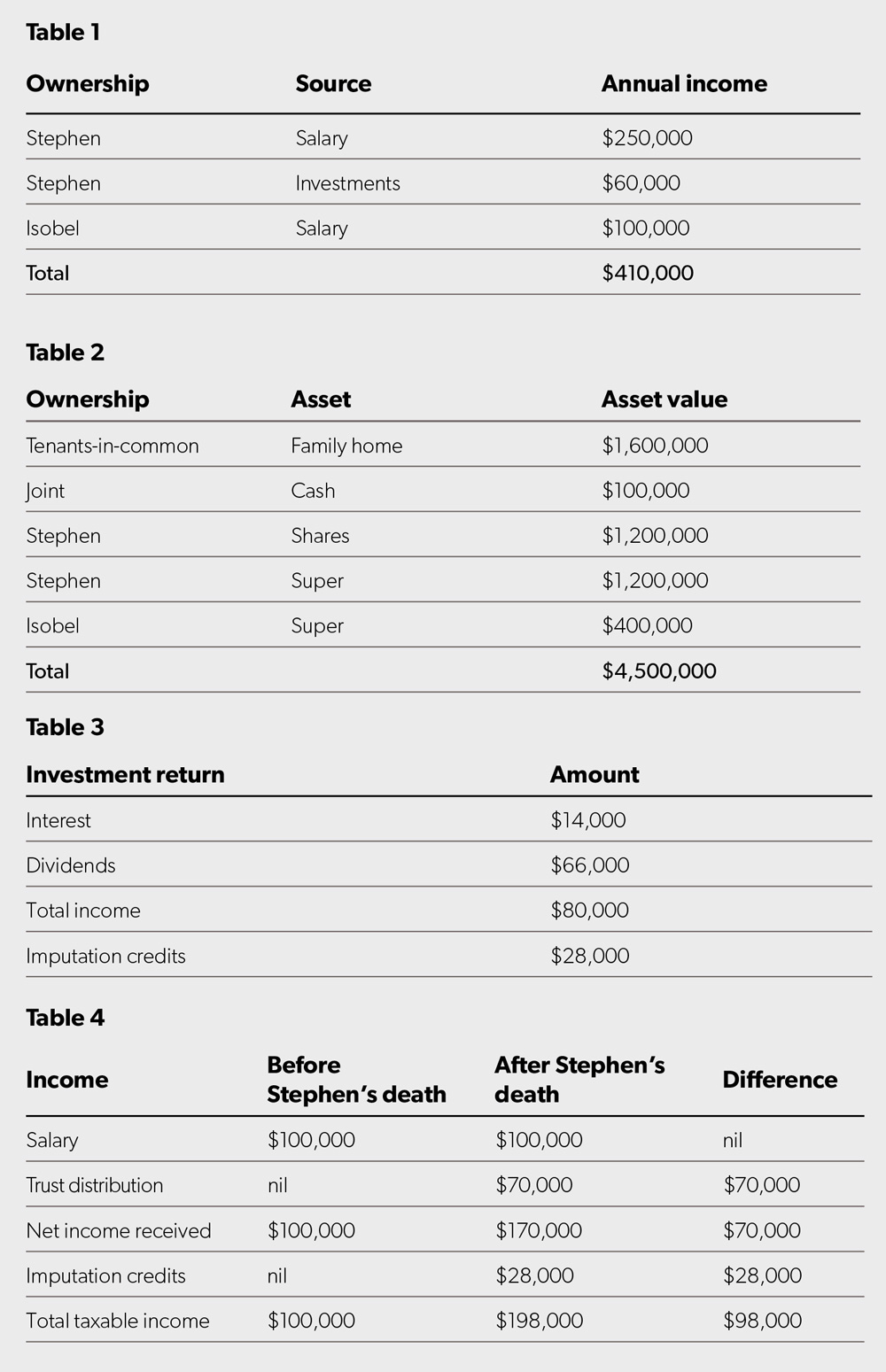

Stephen and Isobel have been married for two years and are both 56. They both have two adult children from previous marriages and have four grandchildren. They have a comfortable lifestyle and currently have the income and assets shown in tables 1 and 2.

If one of them was to die, they want the survivor to be able to maintain a comfortable lifestyle and remain in the same home. Upon the death of the surviving spouse, they want all four children to benefit relative to the assets their parents brought to the relationship.

As Stephen and Isobel are both over preservation age, in order to maximise the tax efficiency of investment returns, they both have transition-to-retirement pensions (with 100 per cent taxable components) for the majority of their superannuation.

Estate planning

Stephen and Isobel contributed equally to the purchase of their home and they structured the ownership as tenants-in-common. This means that if one of them were to die, the survivor does not automatically own the whole home. They each own half of the house and can therefore deal with their half in their will, and eventually pass their share to their own children.

Stephen and Isobel have wills prepared that provide a life interest for the surviving spouse to live in the family home. Stephen completes a nomination in his SMSF which compels $400,000 of his death benefit to be paid to Isobel and the balance to be directed to his estate, along with his share portfolio. These funds will be used to create a life interest trust on his death with the trust income paid to Isobel and the capital paid to Stephen’s children, following Isobel’s death. Stephen acknowledges this may not be as tax-effective as passing all of his superannuation to Isobel, however, he is keen to ensure Isobel maintains a comfortable lifestyle, while leaving the remainder of his estate to his children.

Isobel’s will also provides a life interest for Stephen to live in the family home. However, as Isobel’s superannuation is relatively modest in comparison to Stephen’s income and she has no other assets, her superannuation will be paid to her children.

A short time passes and Stephen dies suddenly in a road accident and their estate plans are activated.

Isobel continues to live in the house and receives a $400,000 tax-free payment from Stephen’s superannuation. She retains her job and salary and has access to income from the trust created from Stephen’s shares and the balance of his superannuation. The trust allows Isobel to distribute the income to herself, her children or grandchildren, Stephen’s children or grandchildren or nominated charities. The capital of the trust remains protected for Stephen’s children.

In the first year, the trust produced the investment returns as seen in Table 3.

Of the trust income, $10,000 is used by the trustee to pay for expenses on the property and $70,000 is distributed to Isobel. Isobel’s tax position is in tables 4 and 5.

As the trust allows discretion as to how the income is distributed, Isobel can generate tax efficiencies by distributing income to the grandchildren. Isobel requests that the trustee distributes $17,500 to each grandchild. The tax position of the distribution for each child is then as in tables 6 and 7.

By having the flexibility to distribute income to the grandchildren, Isobel has increased the total disposable cash for the family unit by $35,428 ($93,408 – $57,980).

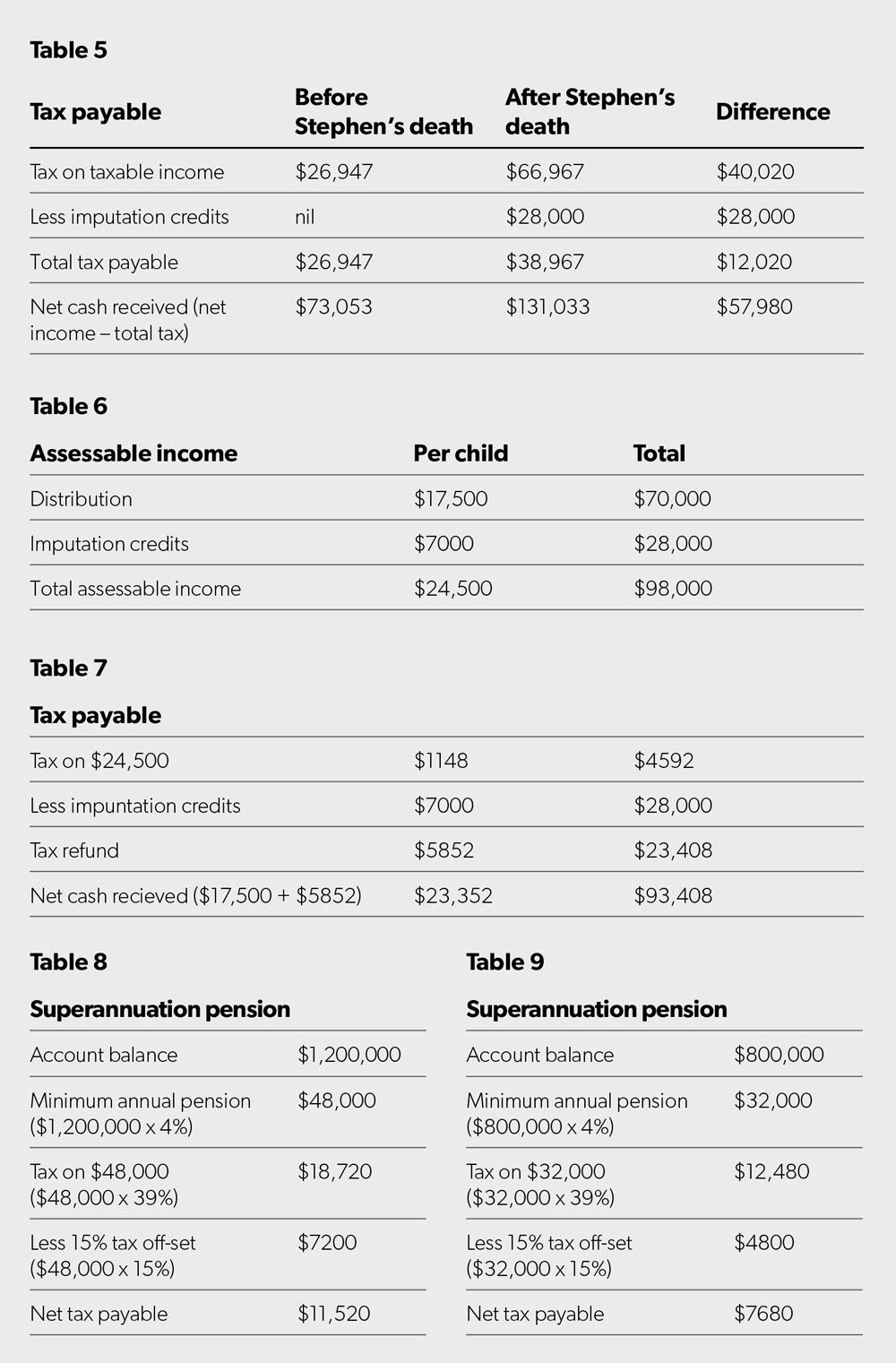

Testamentary trust versus SMSF income stream

If all of Stephen’s superannuation had been paid to Isobel as an income stream and she drew down the minimum annual pension amount, she would be paying $11,520 in tax (see table 8). If Isobel took $400,000 as a tax-free lump sum and then drew the minimum annual pension amount from the remaining $800,000 of Stephen’s superannuation, she would still be paying $7680 in tax (see table 9). In this case study, receiving a death benefit pension from the SMSF is not as tax-effective as using a testamentary trust to distribute income among the family. In addition, Stephen will achieve his objective of leaving assets to his children.

Conclusion

A regular review of a client’s individual circumstances ensures their estate planning goals are being met. Both testamentary and life interest trusts can be effective estate planning structures for clients seeking to balance tax minimisation with distributing wealth to their desired beneficiaries.