All SMSFs are required by law to formulate and adhere to an investment strategy. In the second instalment of this two-part feature, Grant Abbott details the remaining components, both legislative and otherwise, to take into account when creating this critical element of an SMSF.

An investment strategy is a plan established by the trustee of a superannuation fund to achieve one or more investment objectives and primarily for one or more superannuation purposes.

Importantly, the trustee is required by the Superannuation Industry (Supervision) (SIS) Act 1993 to not only document an investment strategy, but also to ensure it is implemented.

In the first part of this two-part feature we looked at three of the five critical compliance areas associated with the investment strategy – the trust deed, the Corporations Act and the SIS Act.

This article will examine the remaining compliance components – the Income Tax Assessment Act 1997 (ITAA) and the necessary investment strategy documentation.

Income Tax Assessment Act 1997

There has been much discussion in the past two years about the tax exemption for segregated pension and unsegregated pension assets in the fund. In particular, the tax commissioner has released Taxation Ruling 2103/5, which extensively discusses the issue of when a pension ceases and commences, which is not the subject of our investment strategy discussion.

From a general perspective there is a specific exemption for segregated current pension assets and a proportional exemption for unsegregated pension liabilities. For segregated pension purposes, section 295-385(1) of the ITAA provides that:

“The ordinary income and statutory income of a complying superannuation fund for an income year is exempt from income tax to the extent that:

a. it would otherwise be assessable income;

b. and it is from segregated current pension assets.”

In that regard, segregated current pension assets are defined for account-based pensions at sub-section (4): “Assets of a complying superannuation fund are also segregated current pension assets of the fund at a time if the assets are invested, held in reserve or otherwise being dealt with at that time for the sole purpose of enabling the fund to discharge all or part of its liabilities (contingent or not), as they become due, in respect of superannuation income stream benefits:

c. that are payable by the fund at that time; and

d. prescribed by the regulations for the purposes of this section (that is, account based-pensions).”

If a fund consists only of pension members, then it meets the definition of segregated current pension assets and the whole fund is exempt. The only change to this would be where the fund maintains a pension, anti-detriment or some other reserve – these are not tax exempt pursuant to section 295-385(6) of the ITAA.

If the fund consists of both pension and accumulation superannuation interests and assets, then the trustee of the fund has two choices.

1. Segregation of pension assets

The trustee of the fund may segregate the assets or set aside the assets of the fund that are to be used solely to meet the fund’s current pension liabilities.

As a result, all income and expenses relevant to these segregated assets must be booked for accounting purposes to the segregated current pension account, likewise any gains or losses.

As such, a separate investment strategy may be considered for the segregated current pension assets and should reference the fact the investment strategy is for the sole purpose of meeting the fund’s current pension needs.

Technical note: However, when segregating, the commissioner has made it known that to take advantage of segregation in this manner would require a separate bank or cash account to be maintained for the segregated assets.

In Taxation Determination 2014/7, the commissioner provided an example that would meet the relevant criteria:

8. A complying superannuation fund has a bank account with a balance of approximately $100,000 from time to time, and a one-year term deposit with a balance of $200,000.

Both the term deposit and bank account hold monies and are invested solely to enable the fund to discharge liabilities in respect of the superannuation income stream benefits for two of its members.

9. The fund holds another bank account with a balance of $250,000 in respect of the superannuation benefits of one other member who is yet to retire and is still in the accumulation phase.

10. The fund also holds a real property rented as commercial premises, and shares in listed companies.

11. The records of the trustee of the fund record the purpose for which each bank account, the term deposit, the real property, and the shares are held.

The accounting records and financial statements of the fund also deal with them on the basis that they are held for different purposes.

12. Each bank account and the term deposit can be treated as separate assets.

As separate bank accounts are maintained to discharge liabilities in respect of superannuation income stream benefits payable by the fund at that time and for the other liabilities of the fund, the term deposit and bank account supporting the liabilities in respect of superannuation income stream benefits are segregated current pension assets for the purposes of section 295-385 of the ITAA 1997 (subject to subsections 295-385(5) and (6), and where the additional requirements of paragraphs 295-385(3)(b) or 295-385(4)(b) are met).”

2. Pooled or unsegregated pension assets

In contrast, in a pooled investment strategy, all the members of the SMSF generally share in the fortunes of the fund’s investments on a proportional basis.

In terms of any allocation of income, this will be outlined in the trust deed and in most cases requires the trustee to allocate income and gains to members on the basis of the balance of each member’s account.

For tax exemption purposes, section 295-390(1) provides that a proportional tax exemption is allowed, determined by the formula contained in sub-section (3):

- Average value of current pension liabilities

- Average value of superannuation liabilities

The proportional exemption is only available where an actuary has provided a certificate prior to the lodgment of the fund’s return for the income year.

- Pooled v segregated pension assets

- Pooled investment strategy

Advantages

- It follows most SMSF software administration programs as they stand at present.

- Only one investment strategy is needed for the entire fund.

Disadvantages

- The trustee must run one investment objective for the fund, which can be difficult and risky from a compliance point of view if members are of different ages and stages in their lives.

- An investment objective and strategy needs to be designed for the members it represents and with a wide range of members with different superannuation needs, running one investment strategy can be limiting.

- Further, with employee superannuation choice, many established SMSFs will bring in younger working family members to become members of the fund.

- Careful consideration must be given by the trustee of the fund to the investment objective for these younger members and also the investment strategy to meet that objective.

- It provides little flexibility in allocating earnings.

- It generates negative earnings or a reduction of capital across all member accounts in poor investment years.

- The trustee that controls or dominates the fund generally calls the investment shots. As the trustee is often an older member, a conservative investment strategy may be adopted against the desires of the fund’s younger members.

- The tax exemption for pension investments is proportional under section 295-390 of the ITAA and requires an annual actuarial investigation that may cost $100 or more a year.

Separate and segregated investment strategies

Advantages

- Separate and segregated investment strategies are suited to funds with members of different ages and investment profiles, and at different stages in their life.

- They are tailored to the investment objectives of the member.

- They allow the member to do their own thing with the proviso that the trustee signs off on the investment strategy.

- They provide easy allocation of earnings, with income and capital gains in a member’s superannuation interest allocated to that interest.

- Earnings related to income stream superannuation assets are tax free under section 295-385. In addition, imputation credits may still be used by the trustee of the fund to reduce fund taxation and if there are excess credits, then these are to be refunded. The trustee may also require accumulation members to pay for the use of imputation credits sourced from the fund’s pension assets that may reduce any tax liabilities specific to the fund tax on contributions.

- They provide for some tax planning through the choice of investments within the strategy.

Disadvantages

- Multiple investment strategies are required, meaning the trustee, their SMSF professional and the administrator of the fund have more work to do to get the best out of the investment process.

- From an accounting perspective, separate and segregated balance sheets and profit and loss accounts must be drafted for each member, their separate and segregated accounts if any and then consolidated for the fund, although this may be an advantage for some funds.

Advance strategy: pooled and seperate/segregated strategies in one SMSF

The trustee of the fund may run both separate and segregated investment strategies and a pooled investment strategy in the fund. The pooled investment strategy could be used for members of the fund with similar investment objectives, while separate and segregated investment strategies are tailored for those members with specific investment objectives or investment criteria.

Under the superannuation interest laws, generally a trustee of an SMSF would run a separate and segregated investment strategy for one or more income streams with various lump sum accounts participating in a pooled investment strategy.

Switching from a pooled to separate and segregated investment strategy in an SMSF

It is not a difficult exercise for the trustee of an SMSF to switch from a pooled to separate and segregated investment strategies in an SMSF

It is a matter for the trustee to determine the account balances in the accumulation and pension accounts in the fund and then picking the assets in the fund best suited for an income stream interest. It should be noted the segregation can be completed by way of detailed resolution.

Case study on segregation

John is 55 and commenced a transition-to-retirement income stream (TRIS) on 1 July 2014 with $300,000, which has 75 per cent tax-free and 25 per cent taxable components. He intends making further salary sacrifice contributions. His wife Sue, 51, is also in the fund with $150,000 in her accumulation account, all of which is a taxable component.

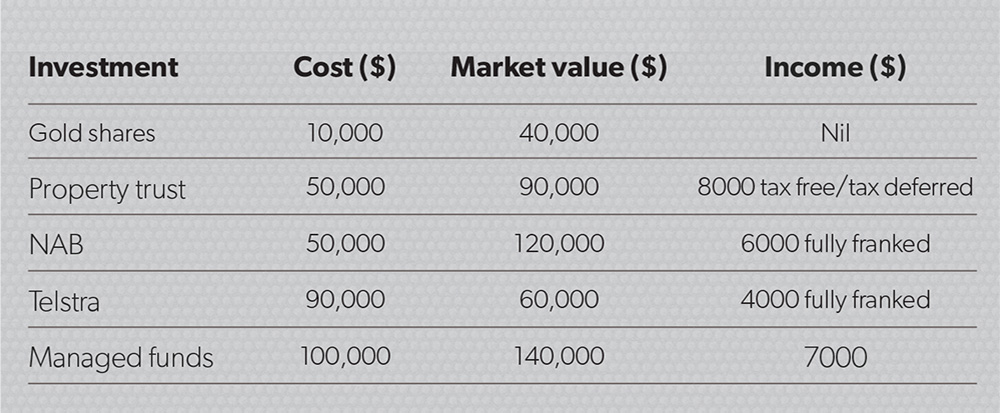

The fund’s investments are as in Table 1.

Let’s consider the current possible SMSF tax and member tax-free/tax-deferred position of the members under pooled or segregated and separate super interests.

Table 1

A. Pooled investment strategy

In relation to tax, the current tax-exempt portion of the fund relating to income stream assets is 66 per cent, subject to actuarial advice. The assessable income of the fund is $29,300 after grossing up for the franking credits.

The non-exempt part is $9766, with tax payable at 15 per cent of $1465, assuming no deductions.

The franking credits available are $4300. This means the trustee’s tax position is a refund of $2835 before taking into account any contributions tax from salary sacrifice contributions.

What would happen if the trustee sold the property trust? If the trustee sold the property trust, then after the capital gains tax discount there would be $26,670 of capital gain.

The next step is to take into account the tax exemption, which would result in $8800 of assessable income. The fund’s tax position, taking into account franking credits, would be a refund of $1515.

B. Segregated and separate investment strategy

In regard to tax, the trustee should consider leaving the gold shares and also the property trust in Sue’s lump sum interest. All other assets are to be allocated to fund John’s TRIS.

When the lump sum interest receives the tax-free income, although received on the taxable side of the fund, it will be tax free. There is no tax payable on any income on this side of the ledger under section 295-385 of the ITAA.

The franking credits are still available to the fund, resulting in a tax refund of $4300, or can be used to provide a greater degree of contributions tax shelter in the fund.

What would happen if the trustee sold the property trust?

Prior to the sale of the property trust, the trustee should hold a meeting and authorise the transfer of the property trust to the tax-exempt TRIS side of the fund in order to provide future cash balances to meet the fund’s income stream commitments.

The transfer must be at market value and an equal amount of assets from the income stream interest should be transferred across to the Sue’s lump sum interest.

If these are to be the shares, preferably after they pay their fully franked dividend.

As such, the fund will still obtain a tax refund of $4300.

Compliance documentation

Although there is nothing in the law that requires an investment strategy to be in writing, without the written word there is no proof the trustee has met their requirements and that spells danger for the planner, accountant or administrator.

Section 55(1) of the SIS Act requires all people to obey the governing rules of the fund, which we saw under section 52B for SMSFs includes the necessity of completing an investment strategy.

With section 55(3) enabling the members to recover any financial losses from the trustee or their advisers for investments made without a strategy, the importance of the documentation is paramount, not just for the trustee, but for everyone who touches the fund.

It will not take long for the litigation lawyers of this world to start to see the potential goldmine in section 55 and then we will all be scrambling for a well-written and comprehensive strategy.