Advising SMSF clients can be rewarding but also disastrous if not carried out properly. Grant Abbott details five crucial steps for advisers to follow to avoid the common pitfalls.

I have just finished my latest and definitely final book on SMSFs. I thought my last book in 2008 would be the pinnacle of my career, but nine years on, with so much more business and practical experience, this book is my legacy to the SMSF industry. SMSFs have given me and hundreds and thousands of others an amazing platform for strategy, long-term wealth creation and, for us as advisers, challenges at every level.

Now with the complex rules that apply from 1 July 2017 in relation to the pension transfer balance limit of $1.6 million, the future of SMSF advice is unlimited. The harder, the better I say.

Anyway, my wealth of experience shows that to be a successful adviser on any SMSF undertaking, strategy or transaction, there are at minimum five important steps that must be completed. Unfortunately, I have seen on numerous occasions where professionals have made a big, costly mistake or have missed one of these five steps.

A case in point is Australian Prudential Regulation Authority (APRA) v Holloway [2000] FCA 579. In that case a very experienced accountant, Anthony Holloway, who had a successful accounting firm in Adelaide, provided advice to a number of his clients in relation to a specific scheme. The scheme involved the clients, essentially ones in small business, to set up an SMSF, contribute money into the fund and then invest that money into a unit trust that was wholly controlled by the fund.

As an aside, the laws in relation to investing in unit trusts, as we will see later, were changed in 1999. However, the Holloway case related to the laws prior to this time, which allowed an investment in a wholly controlled unit trust. Anyway, once the monies were transferred to the unit trust they were then lent back to the small business, effectively generating a tax deduction for money going in and coming out again. The laws at the time prevented a trustee of a superannuation fund from lending more than 5 per cent of the assets of the fund to a related party – the in-house assets test. Now as this was through a unit trust, there was no apparent contravention of the laws as it was the trustee of the unit trust that lent the money.

However, the court found Holloway had breached the anti-avoidance rules of the in-house assets test in section 85 of the Superannuation Industry (Supervision) (SIS) Act and that there was a scheme and the intent of the scheme was to avoid the operation of the in-house assets test in section 84.

And here is the important point for all advisers. In the Federal Court, Justice Mansfield stated: “Mr Holloway gave evidence. He accepted that he, and he alone, was the mind of Holloway & Co. His evidence was that he did not think that the transactions in which he or officers working under him played a part were improper … He did not believe that the structure led to the creation of in-house assets. Put simply, the respondents contended that APRA had not established the intention required by s 85(1).”

And here is what Justice Mansfield had to say about Holloway: “Mr Holloway is an experienced accountant, having worked first in the United Kingdom and from 1967 in Australia … Mr Holloway knew that a regulated superannuation fund was restricted in its ability to invest in, or lend monies to, the employer-sponsor … He understood that direct investment in, or loans to, an employer-sponsor were restricted by the OSS (Occupational Superannuation Standards) regulations. He said he knew of the act in a general way, including in 1993 when it was soon to come into force, but did not apply his mind to how it might impact upon the various transactions now under consideration … That claimed level of ignorance is in contrast with his knowledge of other aspects of legislation relating to regulated superannuation funds, namely the levels of contributions available to employer-sponsors to attract the taxation concessions, and the inability of superannuation funds to borrow monies. It is also in contrast with his general insistence on the need for an arm’s-length trustee, a matter to which almost all of the witnesses who were trustees of superannuation funds referred.”

In the end, the Federal Court handed down penalties amounting to $257,000 against Holloway and his firm for carrying out a scheme to avoid the in-house assets provisions of the SIS Act. It is important not to allow this to happen to you.

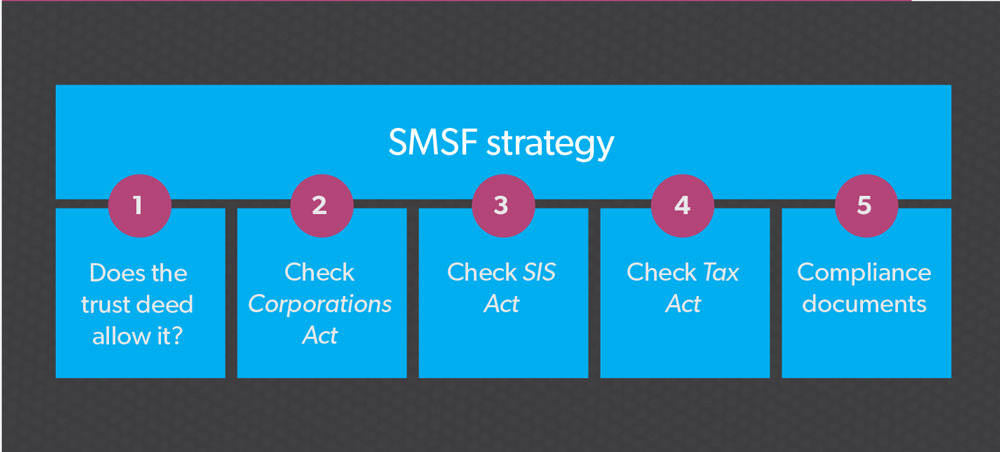

It is crucial for all accountants, financial planners, lawyers, auditors and SMSF trustees to understand and acknowledge the need to know the law and the fund’s trust deed (which forms part of the law). Ignorance is no excuse. So let’s move on to my five-step SMSF strategy success model.

Figure 1: The five steps for SMSF strategy success

1. The trust deed – does it allow the strategy?

We will look at the trust deed in detail shortly as it is a vital cog in the strategy wheel. To that end, section 55(1) of the SIS Act provides that no one can breach the provisions of the fund’s trust deed. This means trustee, member, auditor or professional. Here is a little test for you. The fund’s trust deed at rule 2 says the following, which is very common for SMSFs with individual trustees: “The fund is for the purpose of paying old age pensions only.”Now George Smith, who is a retired member of the Smith SMSF and one of two individual trustees of the fund, receives a lump sum of $50,000 from his accumulation account in the fund. So has there been a breach of the trust deed and thereby the superannuation laws and who has breached the laws and what are the penalties?

2. Corporations Act 2001

Now this one is scary because the Australian Securities and Investments Commission (ASIC) regulates SMSF advice. The regulator stipulates:If a person recommends a financial product they must:

- be licensed to provide advice on the financial product,

- provide the client with a financial services guide that authorises them to advise on the specific financial product,

- review the client’s specific circumstances and provide a statement of advice detailing how the financial product fits the client’s circumstances.

If an unlicensed accountant recommends an SMSF trustee to invest in a specific exchange-traded fund, as this is a financial product and the accountant is unlicensed, then there is a breach of the Corporations Act, which will ensure ASIC will rain down pain on the accountant.

An SMSF is not a financial product but a collection of financial products, which means it is extremely dangerous. First and foremost a trustee of an SMSF is exempt from being licensed, so that is a huge let-off. However, any accountant, financial planner, auditor, real estate agent, mortgage broker, lender or in some cases lawyer that recommends any of the following interests in an SMSF must be licensed and follow the procedures in i. above:

- setting up an SMSF,

- making a contribution to an SMSF,

- advising a client to roll over monies from an industry, retail of other superannuation fund and transfer it to an SMSF,

- recommending any specific financial product investments like shares, unit trusts and options,

- recommending or advising a person to become a member of an SMSF,

- advising a member to commence a pension,

- advising a member to set up a binding death benefit nomination or SMSF will.

Great care should be taken by trustees, licensed advisers and accountants on where and when any transaction fits within the breadth of the Corporations Act and the absolute statutory requirements for a statement of advice under that act.

3. SIS Act

In SMSFs change happens almost weekly, so it is vital any person advising a trustee or member of an SMSF keeps up to date not only with the laws and regulations, but also the latest strategies. It is better to be in front of the curve, not languishing as a laggard.From the point of view of the commissioner of taxation, regulating the SMSF compliance side of the industry has been a blessing. Where else can we get 60-page taxation rulings on business real property and contributions with detailed legal opinion without having to get lawyers to give their views while disclaiming them anyway.

In short, keep up to date. And if you are not in front of the 1 July 2017 changes for your clients, then look at section 55(3) and section 218 of the SIS Act.

4. Income Tax Assessment Act 1997

A significant number of transactions undertaken by a member or trustee of an SMSF have a tax impact. That is the very nature of an SMSF – it is a concessionally taxed superannuation fund and the government has put limits on contributions, both concessional, where a member claims a tax deduction, and also non-concessional. In addition, there are limits on the amount of concessionally taxed pension income the trustee of a fund may use as a transfer balance for a member from their accumulation account to a pension account. As such, the trustee and their professional advisers must be on top of the tax side of each transaction.More often than not I see a strategy proposed that has a particular tax angle and when run through the five-step compliance model it fails one or more of the steps – in particular the trust deed and the SIS Act. This usually requires a rework in order to get to the desired tax result.

5. The SMSF transaction documentation

This is by far the weakest point of most transactions, arrangements or undertakings by a trustee. Wholeheartedly this is the domain of the professional and the trustee should be able to rely on the professional adviser, whether the accountant, administrator or financial planner, to pull together all the requisite documents and pieces of the strategy. This includes interaction with the regulators of various components of the transaction. This was seen in the case of Katz v Grossman [2005] NSWSC 934 where the senior member of an SMSF died and instead of paying out his superannuation benefits to his estate for equal distribution between his daughter and son, his daughter, who was the remaining member and trustee of the fund, refused and held it back. The argument was that Ervin Katz, the father, had put in place a binding death benefit nomination for a distribution of his superannuation benefits to his estate.

That was what he desired. But the New South Wales Supreme Court held the death benefit nomination that was made was non-binding as it had not been approved by the trustee – a crucial procedural step missed by the trustee and advisers to the fund. As such, the remaining trustee was authorised to make the payment to herself. Interestingly, the son’s counsel argued the daughter, Linda Grossman, was not validly appointed as trustee, but the court reviewed the trust deed and relevant documentation and declared her to be validly appointed and the continuing trustee. So when she paid all of her father’s superannuation benefits to herself, the court held she had the absolute right to do so because the advisers to the fund did not put in place the appropriate documentation.

Summary

I love SMSFs and for those of you who know me I love change. Innovation, creation and strategy is the spice of life. So learn more, love your strategising. To that end, I would like to offer you a free copy of my book, The Guru’s Guide to SMSFs. Contact me at [email protected].