Perceived safe investments may not be so sound when it comes to a comfortable retirement. Richard Stacker explains how direct property can beat cash and term deposits when looking for lower-risk investments and sustainable income.

Every asset class has different characteristics, as well as similarities, to consider. Term deposits and direct property offer reduced volatility of returns when compared to shares and listed property trusts. Lower volatility is especially important to investors looking for consistent returns with lower risk over the long term.

Following the global financial crisis (GFC), investments such as cash and term deposits became even more popular as a safe haven. This is particularly true for SMSFs, which according to research by Russell Investments and the SMSF Professionals’ Association of Australia held around 34 per cent of their portfolios in cash and term deposit-like instruments in 2012.

While investing in cash is traditionally considered low risk, holding high allocations to cash over the long term has the potential to materially erode the value of retirement savings. In the past decade, the purchasing power of one Australian dollar has eroded by over 30 per cent, according to the Reserve Bank of Australia (RBA), signifying that investments need to provide significant real returns (net of tax and above inflation) to maintain and grow long-term savings.

In Australia, investments in cash and term deposits have historically provided significantly lower returns than investments in direct property funds. The Mercer/IPD Unlisted Property Funds Index and UBS 90-Day Bank Bill Index show that over the 10 years to 31 December 2012, cash returned 5.4 per cent annually, with Australian unlisted property funds returning 9.2 per cent annually. Over the past decade, including the GFC’s impact, Australian unlisted property funds outperformed cash by 3.8 per cent annually.

Direct property – an alternative to term deposits

The Australian commercial real estate market is relatively small in size in contrast to the country’s total superannuation savings and total cash savings. According to Investment Property Databank (IPD), the total size of investment-grade property assets was about $120 billion as at 30 June 2011.

Commercial real estate valuations offer compelling value at this point in the market cycle, with above average historic income yields and above average prospective total returns. As Australia’s superannuation sector continues to grow and the large pool of cash moves to higher-returning opportunities, commercial real estate is likely to provide solid capital growth, in addition to the current high income yields available.

While those SMSF investors who are comfortable with purchasing residential property would find the entry cost to commercial property a barrier (institutional-grade assets start at $15 million), there is another option. Alternative ways to access commercial property include real estate investment trusts (listed property trusts), unlisted (direct) property trusts and syndicates, which cover the office, industrial and retail sectors.

Term deposits versus direct commercial property

Term deposit rates offered by Australian and international banks have decreased considerably in recent years. According to RBA statistics, the average rate on a three-year term deposit fell from 7 per cent in early 2010 to 4.45 per cent in March 2013.

The current average one-year term deposit rate is lower again at 4.05 per cent, and that headline rate ignores the effect of inflation. Assuming inflation of 2.6 per cent (which is the average consensus forecast) during 2013, the return from cash after the effect of inflation falls to about 1.4 per cent. Considering that tax needs to be paid on the interest earned, the real return for an SMSF investor (after tax and inflation) would drop to 0.84 per cent.

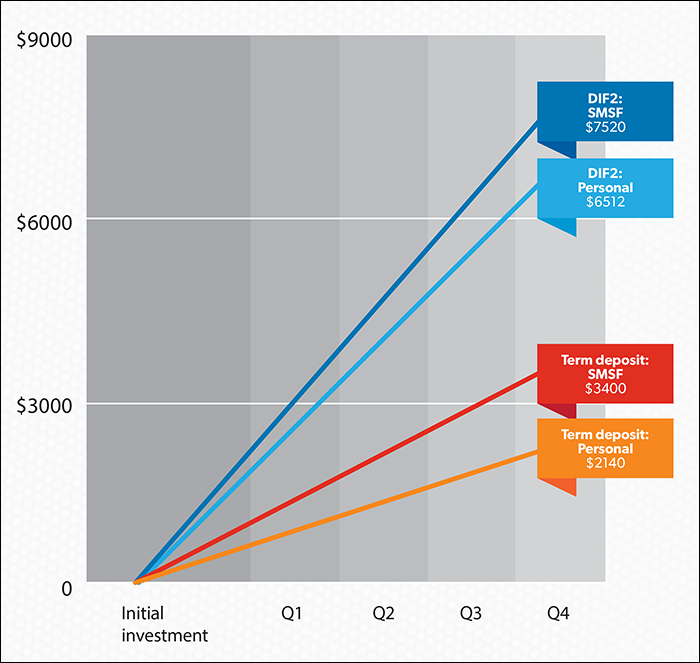

Putting this into an income perspective, Figure 1 compares a $100,000 investment by an SMSF investor in an unlisted property vehicle at an 8 per cent yield versus a term deposit at 4 per cent. Over one year, the investment in unlisted property would generate $8000 in gross annual income or $7520 after tax. The term deposit by comparison would provide gross annual income of $4000 or $3400 after tax, less than half the income for the same capital investment. To demonstrate the advantages of investing via an SMSF vehicle at a tax rate of 15 per cent, the graph also includes the income received on the same investments by a personal investor on the highest personal tax rate of 45 per cent plus 1.5 per cent Medicare levy.

When looking for sustainable income to fund retirement, the income example of a term deposit versus direct property demonstrates how supposedly low-risk term deposits may actually pose a higher risk to portfolios in terms of meeting income needs.

Figure 1 – Income returns for Charter Hall’s DIF2 vs TDs for SMSF investors and personal investors on the highest personal tax rate on an investment of $100,000 over one year

Sector plays: industrial property

In the current, low interest rate environment, term deposit rates have dropped and bond yields have become less attractive. This emphasises the need for growth assets to become more defensive within a portfolio. Within direct property sectors, industrial/logistics property is proving attractive to investors, particularly SMSFs, seeking income returns with reduced levels of risk. The high level of income returns on well-leased prime industrial property are showing spreads to the five-year bond rate of around 5.5 per cent and above, making industrial property one of the most attractive asset classes for risk-averse capital. The long-term leasing structure of prime industrial property is seen as somewhat of a high-yielding safe haven for capital, given current global uncertainty.

The outlook for the sector is also strong, with a recent fund manager survey by JP Morgan indicating industrial will be the top-performing sector over 2013. Performance to support fund manager sentiment also came from the latest IPD data showing the sector was the second strongest performing of the major asset classes over the year to the fourth quarter 2012, with office property only narrowly beating it by 0.1 per cent.

This performance, coupled with the strong flow of investment funds from advisers into securely leased industrial portfolios that resulted in some funds closing oversubscribed in 2012, shows quality industrial is now viewed as an ideal capital safe haven providing a yield well above current cash rates.

The demand for industrial property has been particularly strong among SMSFs, which account for as much as 60 per cent of new inflows into Charter Hall’s direct industrial funds. The appeal of this asset class for SMSFs lies largely in its long-term outlook, SMSFs’ insensitivity to the illiquid nature of the asset class and the inbuilt gearing in the property fund.

The income returns net of any capital growth are another highlight as illustrated in the income example above. For SMSFs, the capital growth inherent in a direct property investment is a hedge against inflation and can materially assist them to reduce the risk of their investments being eroded by inflation over time.

The time is now

At this point in the cycle, term deposits warrant some caution for those SMSFs attempting to build long-term wealth sufficient to offset the threats of inflation and tax leakage. An investment in cash during periods of inflation seriously erodes the purchasing power of retirement savings.

A conservatively geared direct property investment can reduce an overall balanced portfolio’s volatility and increase overall returns.

Investor case study

Why I invest in direct property

Sydney-based David Shein, chairman and founder of Com Tech Communications (now Dimension Data), has invested in unlisted property funds and syndicates for over 20 years. Shein invests in direct property for his SMSF, personal portfolio and family trust.

He invests around 20 per cent of his portfolio in direct property. “There are two main reasons why I invest in direct property, firstly to diversify my portfolio of assets and secondly for the quarterly income I receive from these investments,” he said.

In 1987, he learnt the hard way that it isn’t easy to make a quick buck. After investing every cent he owned into a company that went into insolvency, he took a different approach and ensured he held a more diversified portfolio of investments.

He went on to make what he describes as the best investment of his life. “I invested in my own company, Com Tech Communications. The success of this business allowed me to balance my portfolio by investing in competent and well-organised assets through property funds,” he says.

“The performance of the direct property investments in my portfolio has been unbelievably good, sometimes astonishingly good. Of course, the global financial crisis didn’t help anyone who invests, although the testing time taught me to really appreciate my relationship with property managers.

“In times like these, where the cash rate is sitting at 3 per cent and there is renewed investor confidence, strong direct property investments which provide good returns are very attractive to investors.”

When asked about the illiquid nature of direct property investments, he didn’t appear too concerned. “It’s all part of having a diversified portfolio. You need to balance your short-term, medium-term and long-term investment objectives. I don’t invest in direct property for short-term results; I have a balanced portfolio and property funds are very attractive long-term investments,” he says.