The majority of SMSF portfolios have a significant allocation to cash, but this may not provide trustees with a robust enough defence against adverse market movements. Chris Dickman demonstrates how active fixed-income management can be a more effective defensive mechanism.

While most SMSF trustees recognise a diversified investment portfolio will smooth out the peaks and troughs of investment market volatility, many of them are failing to adequately provide suitable defensive asset allocation.

Australian Taxation Office statistics show SMSFs hold about 32 per cent of their assets in direct shares and 28 per cent of their assets in cash and term deposits. The cash and term deposit holdings suggest a defensive intent, however, they don’t provide the same defensive characteristics as a combination of fixed-interest investments. While term deposits offer a stable and known income stream, they are not exposed to capital movements and cannot provide true diversification from equities in falling markets.

The role of fixed income in a portfolio

Fixed-interest securities play a crucial defensive role in an investment portfolio due to the diversification benefits they provide against equities. This diversification benefit is a result of the duration exposure offered by fixed-income securities.

Duration measures the extent a fixed-income asset or portfolio moves in response to a change in interest rates. Consider a deteriorating economic scenario. Here, policymakers generally respond to a slowing economy by cutting interest rates. As there is an inverse relationship between bond prices and interest rates, (see box 1), bond investors enjoy a capital gain while equities are generally producing negative returns.

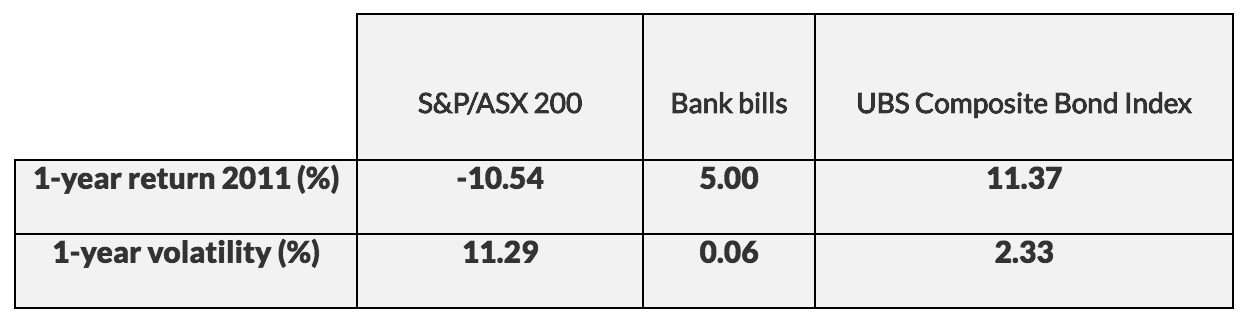

The benefits of duration can be noted when considering returns over 2011 (see Table 1). Australian equities generated a negative return as the market became concerned about global recession and the possible break-up of the European Union. At the same time, the Australian fixed-income market generated a strong positive return, well above cash.

This is at the heart of the diversification role fixed income plays in a balanced portfolio, acting as a hedge when equities are doing it tough. Term deposits and cash holdings do not provide the same level of hedging, as they provide income but not duration. When interest rates fall, there is no change in the value of a term deposit, just a lower reinvestment rate at maturity.

What about when an economy is doing well? In these circumstances equities tend to perform strongly and the buoyancy of equities dominates returns while fixed income plays a more muted role.

Timing market cycles is notoriously difficult for professional money managers, let alone for SMSF trustees. It is unwise to give up fixed-income exposure because you don’t know when you will really need it.

One of the most confusing aspects of a bond is the relationship between a bond’s yield and its price. The golden rule for investors new to fixed income is to appreciate that a bond’s price and its yield move inversely.

Bonds can be actively traded in the secondary market, with their price fluctuating daily. When interest rates rise, the prices of existing bonds in the market will fall to make them competitive with newer bonds that will have higher coupons reflecting the increase generally in interest rates.

An example:

Suppose an investor buys a 10-year government bond with a 6 per cent coupon and $10,000 principal value. Later, interest rates plunge to 3 per cent and new issues now carry a 3 per cent coupon. If an investor is offered the original price, they are unlikely to sell. To give up the right to 6 per cent a year for the next 10 years, an inducement is needed to compensate the investor because interest rates have fallen. That is the basis for the inverse relationship.

An optimal approach to bond market investment, to provide SMSFs with true diversification, is to combine both credit and duration strategies, in an effort to maximise returns in all market conditions.

Credit risk is a key consideration with fixed-interest investment, as it reflects the probability of timely repayment of interest and principal. More creditworthy securities have higher credit ratings and have relatively low probability of default, while lower-rated securities can constitute higher risk.

For instance:

Corporate bonds are generally issued by companies on an unsecured basis. In Australia, the credit quality of the market is high and dominated by major banks and blue-chip industrial companies. These bonds provide higher yields than government bonds, but do have credit risk that must be assessed. Duration risk is the other factor to be taken into account when managing fixed-interest portfolios. In a falling interest rate environment, a longer-duration instrument will enjoy a larger capital gain than a shorter-duration instrument. Some investments, such as cash or term deposits, provide no capital gain potential at all.

Table 1

Why would I hold fixed income when yields are at historic lows?

While most SMSF portfolios tend to be underweight in fixed income, investors are reluctant to increase exposure to the asset class when yields are at historic lows. As the economy begins to recover, interest rates will rise, and bonds will experience capital losses.

Many investors are still haunted by the bond market experience of 1994. Then, aggressive monetary policy led to large losses in bond markets. We don’t expect the magnitude and velocity of interest rate hikes to be this aggressive, however, investors should expect bond yields to normalise in the medium term, which will result in capital losses on long-duration assets.

While the prospect of rising rates does not need to spook investors, there is a tendency for SMSF trustees, and indeed investors generally, to lump all fixed-income funds into the one bucket. But there are many techniques available to active fixed-interest managers that allow them to manage portfolios when interest rates begin to rise. And it is simply not possible to achieve this sort of active fixed-interest management by direct investment. Even traditionally managed fixed-income portfolios and index funds are not going to provide the necessary flexibility for investors to avoid capital losses.

In either a strong or a deteriorating economic environment, active fixed-interest fund managers can add value with well-constructed strategies – adding real value to SMSFs. While it is important for an SMSF to have a reasonable allocation to fixed income, the method of gaining this exposure is equally important.

A nimble management style, driven by an objective of beating both cash and bond returns, is required. An active manager will focus on generating income when bonds are generating capital losses, but is swift to shift the focus to exploit the potential for capital gain when the time is right. The objective is to look after investors in all parts of the cycle, not just when rates are falling or stable.

The types of strategies that may be implemented in a rising rate environment to deliver positive returns include:

- Investing in short-dated bonds, which have a lower duration and are therefore less sensitive to interest rate changes. Short-dated corporate bonds that have a yield above the cash rate benefit from capital gains (and accrued income) as the yield falls toward the cash rate over the life of the security.

- Investing in floating rate notes (FRN). FRNs pay a fixed margin above an agreed level, such as the bank bill swap rate, and avoid the downside of rising interest rates by giving up some of the potential upside if rates fall. In a rising interest rate environment, spread compression can lead to capital gains in FRNs.

- Using interest rate swaps to swap fixed rates for floating.

Another scenario to protect against is a period of inflation. Given most central banks have effectively been printing money to solve the global financial crisis, the risk of inflation in the future is real. An investment that returns 3 per cent in nominal terms in an environment of 4 per cent inflation will produce a negative return of negative 1 per cent when adjusted for inflation.

A serious bout of inflation can be problematic for equities and bonds. It would lead to policymakers aggressively increasing interest rates to slow the economy and push down inflationary expectations. In this instance, the diversification benefits of bonds can break down, with both equities and bonds performing poorly. In this environment, inflation-linked bonds can protect capital from being eroded by inflation.

As the coupon paid is linked to the inflation rate (via an indexed capital value on the principal), this helps to hedge the risk of inflation more effectively than either nominal fixed interest or ‘real’ assets, such as shares. Nonetheless, attention needs to be given to the duration of the indexed bonds, as rising real yields can also produce capital losses for this category of bonds. Therefore, actively managing the duration exposure of these bonds is important. SMSF investors have no avenue to truly to manage this risk directly.

Active fixed-income management often means a bond is rarely held to maturity. An active approach means a bond will only be held until it has reached its return targets and portfolios are carefully monitored and adjusted accordingly and combine both credit and duration strategies, in an effort to optimise returns in all market conditions (see box 2) – something SMSF trustees may find particularly valuable.

What about other sources of income?

When yields on fixed-income securities are low, such as now, SMSF investors can be tempted to chase higher-yielding investments, such as hybrids and high-yield debt, or even bank shares, which offer a high dividend yield. A small proportion of any of these assets can be used to boost returns, but needs to be applied in the right context. These investments do not offer diversification to equity exposure. In fact, in the case of hybrids and high-yield debt, they tend to increase in correlation to equity markets when equity markets underperform. Therefore, they must not be allowed to compromise the defensive functioning of the fixed-income allocation.

Conclusion

The future for bond and equity markets will continue to be volatile, but both investment classes are required to ensure true portfolio diversification. In volatile markets, an active fixed-income manager can add value to SMSF portfolio construction by analysing the market and moving in and out as appropriate. This is an active exposure that individual investors can’t access directly.

The recovery of the global economy has been far from smooth. Regardless of whether SMSF investors believe the global economy will recover, or will deteriorate further, having some fixed-income exposure, especially to provide duration, is important to maintain a balanced portfolio.