SMSF investors looking to maintain a return from dividend yields in the current interest rate environment should consider ETFs as a possible solution, writes Stephen Small.

With interest rates expected to remain low in 2014, the pressure is on for SMSF trustees to find alternative investment options that provide sustainable income in their portfolios.

Couple this with statistics on the massive cohort of baby boomers reaching retirement age and expected to move into the pension phase of their investment life cycle, and the incredible wave of cash flowing into yield-based investments is inevitable. To put this into some perspective, the number of Australians over the age of 65 is expected to increase by 75 per cent over the next 20 years, from 3.3 million in 2012 to 5.8 million in 2032, according to the Deloitte Actuaries and Consultants “Dynamics of the Australian Superannuation System” report.

The demographic shockwave

Delving into what this means for equity markets, a recent white paper issued by UBS Securities Australia, entitled “The Demographic Shockwave”, found this trend is not confined to Australia. Developed world populations are ageing, fertility rates are declining, longevity is increasing, and most importantly baby boomers across the globe are retiring. The UBS analysis shows this ageing demographic has significant implications for economic growth. The paper found older populations result in slower economic growth.

In this environment, UBS’s model suggests demographic shifts are likely to provide a headwind to economic growth for 15 years to come. In a low-growth environment, investors benefit most from high-yielding asset classes, such as government bonds, and property, as the return from income exceeds the return from capital growth. This makes sense. Faced with the prospect of how to deploy their capital, companies are more likely to issue it in the form of higher dividends than invest it in low-growth opportunities.

Given the ageing demographic, the slowing economic environment and the increase in SMSFs, the research suggests defensive strategies, especially sustainable income strategies, are more likely to outperform over the next 15 years.

Just how big is the SMSF market?

The Australian superannuation system is the fourth largest in the world and currently stands at $1.6 trillion. With compulsory superannuation set to increase from 9 per cent to 12 per cent, the Deloitte study estimated this pool of superannuation assets could reach $7.6 trillion by 2033.

Astonishingly, one-third of the current $1.6 trillion of superannuation assets is held within SMSFs and if this trend continues, we could see over $2.5 trillion in SMSF accounts by 2033.

Of the 1 million current SMSF members in Australia, 82 per cent are over the age of 45 and therefore fast approaching retirement. Having the flexibility to manage their own finances, they are now looking for yield-bearing investments to support the lifestyles they have become accustomed to.

SMSFs turn to ETFs for yield-based investments

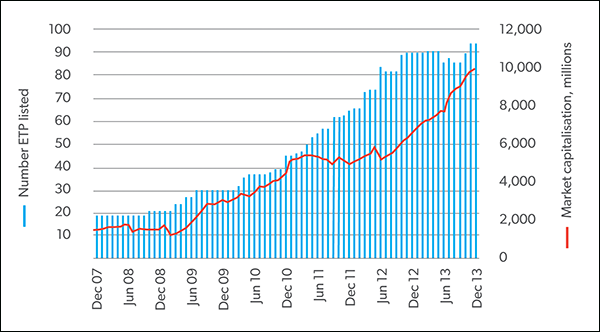

One need look no further than the exponential growth in the exchange-traded fund (ETF) market to realise where a significant portion of this money is going. With the Australian ETF market recently cracking through the $10 billion mark, research shows the single biggest user group of ETFs is SMSFs, making up around 50 per cent of the market.

With close to 100 products across all asset classes, the ETF market has experienced significant growth over the past five years, growing at a cumulative annual growth rate of 43 per cent. Better yet, this trend is accelerating. In 2013 alone, the Australian ETF market grew at a rate of 54 per cent, increasing in size from $6.5 billion under management to over $10 billion.

Part of this growth may be attributed to the increase in fixed income ETFs available to Australian investors. In 2012, the Australian Securities Exchange approved the listing of the first fixed income ETF, and in so doing opened up a new investment option allowing SMSFs to gain direct exposure to government and corporate bonds. There are now 11 fixed income ETFs available with a combined funds under management of over $500 million, which has proven to be another successful tool for SMSFs to diversify their portfolio into other yield-producing asset classes.

Graph1: Exchange-traded product market growth

Source: ASX, “Spotlight on ETPs”, Dec 2013

Dramatic increase in demand for high dividend ETFs

Even more impressive is the dramatic increase in high dividend ETFs. There are now five high-dividend ETFs available in the Australian market with combined funds under management of close to $1 billion. UBS’s tailored strategy is the latest offering to be brought to market to directly address the significant demand for high-yielding investments.

The UBS IQ Research Preferred Australian Dividend Fund is designed by UBS’s Australian equity analysts specifically for the Australian market. The local analyst input differentiates this high-dividend-yield ETF from existing offerings where portfolios are built using straightforward rules. Importantly, this 40-stock equity portfolio offers investors a high yield with franking, and is constructed by focusing on companies with improving balance sheets that can grow their dividends into the future. In other words, it is a sustainable income portfolio.

In an environment where interest rates are expected to remain low, and with the growth in SMSFs showing no signs of abating, ETF use is expected to grow exponentially as the wall of retirement money searches for income-yielding investments. All things considered, income-focused investment portfolios look set for another strong year.