Exchange-traded funds have resonated well with SMSF investors and they are now beginning to realise the tax advantages they can deliver are another attractive characteristic they possess, Amanda Skelly writes.

Diversification, low-cost and simple access to different asset classes, sectors and countries are common benefits cited by investors who invest in exchange-traded funds (ETF). However, many investors are now starting to realise some of the tax benefits ETFs provide, including access to franking credits and the potential for a lower capital gains bill when compared to other types of investment options.

Reduced tax bite and deferrals

ETFs typically generate fewer capital gains distributions than traditional managed funds for

two reasons:

Low portfolio turnover: Because ETFs track an index, they tend to have lower turnover than actively managed funds, thereby reducing the potential for capital gains distributions. This is because an ETF will only sell companies it invests in when the index it seeks to track changes (for example, semi-annually) or for certain corporate actions. Active managers typically sell securities more often based on the portfolio manager’s view on how well a certain company will do.

Secondary market transactions: ETFs trade on stock exchanges, such as the Australian Securities Exchange (ASX), and ETF investors trade with each other on the exchange. Unlike unlisted managed funds, portfolio managers do not need to sell securities to raise cash to meet an investor’s request. One ETF investor’s sell decision has no impact on other investors and capital gains distributions are kept low. These distributions, taxable to all investors, regardless of how long they have owned the fund, can result in a capital gains tax (CGT) bill even in years when the unlisted fund registers a loss.

The unique structure of ETFs gives tax-aware investors a chance to minimise capital gains distributions and allows for more assets to remain invested, in turn increasing the growth potential of the investment.

The advantage of dividend imputation and franking credits

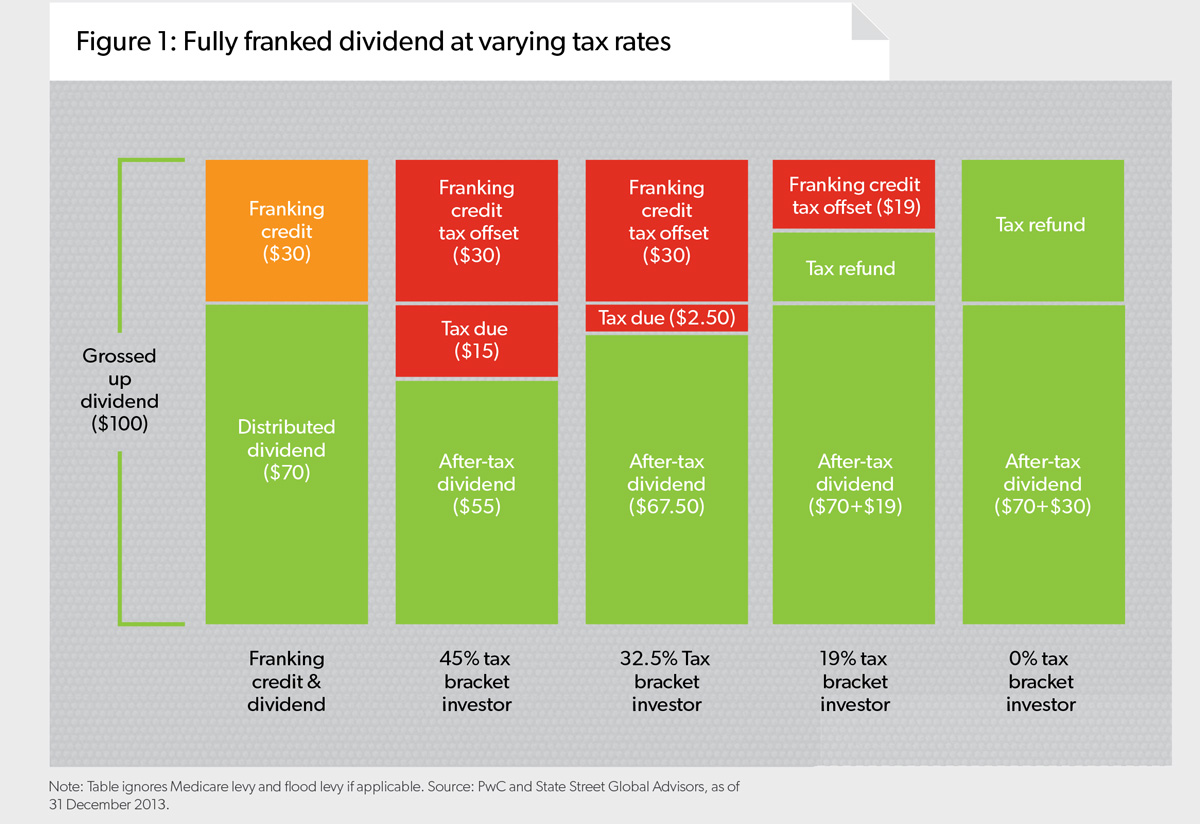

The dividend imputation system in Australia can represent an important advantage for investors. If Australian corporate taxes have already been paid on dividend distributions, then investors do not need to pay those taxes again at the personal level. The corporate taxes paid are attributed, or imputed, to the Australian investor through tax credits (commonly referred to as franking credits). Franking credits can be used to reduce an investor’s total tax liability to account for the taxes on dividends already paid by companies. For individuals or complying superannuation entities, any excess franking credits can also be refunded at the end of the year if the investor’s tax liability is less than the amount of the franking credits. In effect, any dividends investors receive will only be taxed at their respective marginal tax rates.

Let’s look at an example to illustrate. ABC Corporation makes $1.00 per share in pre-tax profit during a given period and would like to pay it all out in the form of dividends. After paying the 30 per cent corporate tax, ABC distributes $0.70 per share in fully franked dividends. To the Australian investor, this is equivalent to being paid an unfranked, grossed up dividend of $1.00 per share. The 30 per cent corporate taxes already paid will accompany the dividend in the form of a $0.30 per share franking credit and act similarly to an IOU from the tax office.

From this we can see that:

Dividend + Franking Credit =

Grossed Up Dividend

The taxpayer must now pay the appropriate level of tax on the grossed up dividend less any franking credit. In other words, the franking credit can be used to offset taxes due on the dividend or entitle the investor to a tax refund. An investor with 0 per cent taxes due will be entitled to receive the entire franking credit back as a tax refund. (See Figure 1 for an example involving 100 shares of ABC.)

In countries without a tax imputation system, investors could have to pay personal taxes on top of corporate taxes already paid, that is, corporate profits may be double taxed at the corporate as well as personal level.

Understanding dividends and franking credits for the Australian ETF investor

A company that pays all its income tax domestically in Australia will usually pay a fully franked dividend, that is, a dividend with a franking proportion of 100 per cent. However, some companies’ franking proportions can be less than 100 per cent, especially those organisations paying taxes outside of Australia. Other companies that do not pay any Australian tax, and have no franking credits from prior years available to roll forward, may pay an unfranked dividend. The franking proportion of a security will therefore have a material effect on after-tax returns, making it an important issue for all investors to consider.

Australian equity-based ETFs represent a basket of multiple companies that pay varying levels of dividends, at varying levels of franking proportions. All dividends and franking credits paid by the companies within the ETF’s portfolio are passed to investors on the ETF’s distribution date. This means investors holding Australian equity ETFs on and around the distribution dates (often these are quarterly or semi-annually) could receive valuable franking credits along with any distributions they receive.

As an example, at 31 December 2013, the SPDR S&P/ASX 200 Fund distributed $1.25 per units in dividends, 90 per cent of which were franked at a rate of 31.1 per cent. This dividend was also accompanied by $0.51 per units of franking credits. Here, the $1.25 partially franked dividend may be equivalent to $1.76 in unfranked dividends. Details of ETF distributions and franking credit portions can be found on the ASX or ETF issuer’s website.

Foreign tax credits and ETFs

Where an ETF invests in overseas companies, some of the income distribution will be withheld from investors (called a withholding tax). The level of withholding tax varies depending on where the company resides and the tax rules in place between Australia and the residing country. For example, Australian investors who buy companies domiciled in the United States will incur a 30 per cent withholding tax on any income distributed by those companies. Australian investors are generally eligible to reclaim some of this withholding tax back as a foreign tax credit. Withholding tax applies for most investments in overseas companies, including if you were able to invest directly or via an unlisted managed fund.

With ETFs this withholding tax flows through to the ETF investor. Some international equity ETFs available on the ASX require that the ETF investor completes the necessary paperwork to reclaim foreign tax credits, however, others, such as the SPDR International ETF family, will do this on behalf of investors. In this instance, the ETF investor will receive an annual tax statement that includes the value of the foreign tax credit.

Tax-free distributions

Under the CGT discount rules, certain tax breaks are available to ETF investors. Specifically, a percentage of the distributions received as a realised gain may be tax free. Depending on individual situations, ETF investors may be eligible to receive up to half of their realised gains tax free.

The importance of advice

To say tax is complicated is an understatement. While the above provides investors with some insight into how ETFs can form part of a tax-efficient portfolio, everyone’s individual circumstance is different and an investor should always consult with an adviser or accountant to learn more about their tax circumstances and the benefits ETFs may provide to their individual investments.