Australians have had a positive, albeit volatile, experience in growth assets such as shares and real estate over the past 20 years. Growth assets have been supported by decreasing interest rates, financial sector reforms and the mining boom. Over this period, corporate debt markets in Australia have remained relatively underdeveloped given the dominance of bank lending and limited private investor demand. However, credit markets are much larger and deeper in offshore regions such as the United States, United Kingdom and eurozone.

Global credit and fixed interest may be a natural asset class for Australian retail and SMSF portfolios, as it is in large institutional funds. The asset class has a long and reliable track record of delivering income. However, it has been underinvested by SMSFs because of the lack of awareness of global credit opportunities, ease of access, misconceptions of relative risk and a bias towards domestic bank deposits and domestic hybrid security investments. As such, SMSFs are missing out on an asset class that is typically incorporated into a balanced institutional portfolio. Credit-based mutual funds are a common investment among high net worth investors in the US and Europe.

The decrease in bank deposit rates over the past few years has been a catalyst for some investors to look towards other income opportunities. Global credit can offer higher regular income than deposits or government bonds with much lower volatility than shares. Exposure to global credit should be accessed through a highly diversified portfolio managed by specialist credit investment professionals.

There are challenges to SMSFs’ historical sources of income. They have typically relied on term deposits and Australian equity dividends to generate regular income from their investment portfolio. However, forward-looking asset class return profiles may differ from the past and may not produce adequate levels of income. In particular, government bond yields are low historically, despite higher inflation risk, while term deposit rates have continued to fall. Share market valuations seem reasonable compared to history, but growth drivers such as high commodity prices may be absent going forward.

Returns from a typical SMSF portfolio, which includes domestic commercial/residential property, domestic shares and term deposits, may prove to be highly synchronised if there was a downturn in the Australian economy.

Why use global credit and fixed interest?

1. Income generation

Global credit and fixed interest securities tend to pay investors regular coupons with a higher yield than cash. A highly diversified portfolio of such coupon-paying instruments can smooth out cash flows, which can be aggregated and paid out as regular income (that is, through monthly global credit fund distributions)

2. Capital resilience – seniority and security of credit securities

Credit investors benefit from having priority of payment above equity investors for payment of coupons and repayment of principal. Senior credit investors rank ahead of hybrid and subordinated debt investors. A credit investor’s ranking in the company’s capital structure is a key determinant of their recovery of investment if a company gets into trouble, and their certainty of receiving ongoing distributions.

In addition to seniority, some credit investments also provide investors with the benefit of security over specific assets of the borrower, providing further protection to the investor. This normally takes the form of a mortgage over property and other assets. These factors mean the market pricing for credit investments has been more resilient than equities.

3. A liquid and resilient asset class

Global credit markets are large and deep. There are a variety of credit investor types, including asset managers, banks, insurance companies, pension funds and sovereign wealth funds. This diversity of investors means credit investments are traded between buyers and sellers even in difficult times, which aids liquidity, visibility and marketability.

Global credit returns have been more resilient than equities. For example, after the global financial crisis (GFC), credit recovered much faster than equities. Global credit is regarded as an intermediate risk profile asset class, with an investment horizon of three to five years (which is less than equities).

4. Diversification/low portfolio correlation

Global credit investments allow Australian investors to diversify away from Australian equities and achieve a broader exposure across issuers and economic/geographic areas. Industry diversification is particularly important because corporate failures may occur in clusters, for example, the technology crash in the early 2000s or financial institutions during the GFC.

Industry diversification is difficult to achieve in the Australian market. Australia is a small economy with a heavy concentration to financial and mining sectors (about 60 per cent of the ASX 200 market capitalisation is within these two sectors). Far greater diversification is available by investing in global markets.

Blending global credit into a portfolio

Investors have the potential to change the risk and return dynamic of their portfolio by changing their asset allocations.

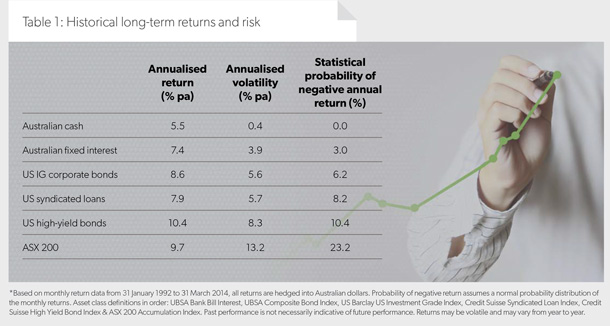

When comparing long-term asset class returns, global credit has been an intermediate risk asset class. Historically, credit has been higher returning and more volatile than Australian government bonds, but has been significantly less volatile than shares. The meaning of return volatility is the likelihood of an asset incurring a negative return in any year increases as the volatility of the returns increases (see Table 1).

Diversity is a key principle in creating a credit portfolio

The number of securities required to create a robust credit portfolio capable of delivering reliable income is many times greater than the diversity required for an equity portfolio.

Credit portfolio management focuses on minimising downside risks and the avoidance of significant exposures to underperformers. A lack of diversity is one of the greatest pitfalls experienced by retail investors seeking to create their own credit portfolios from a small number of available retail credit securities.

Institutional investors typically allocate to global credit via managed portfolios

Australian institutional investors, such as industry superannuation funds, typically allocate to global credit via specialist investment managers. Specialist credit investment managers can bring a depth of research and technical expertise. Given the size and diversity of global markets, there are many companies and securities to cover, necessitating a large analyst team. To make the most of a creditor’s superior position in the capital structure (that is, seniority, security and covenants), detailed analysis of security documentation is required.

Importantly, new-issue credit markets can be difficult to access if you are not a large, well-established market participant. Bentham focuses on rated, institutional quality assets, such as loans and bonds, which are typically positioned higher up the capital structure, potentially benefiting from seniority and/or security. By contrast, retail investors are typically offered the subordinated parts of the capital structure, such as hybrids, with the least creditor protections, and most equity-like risks.

Bentham’s approach to managing global credit portfolios is to create highly diverse, institutional-quality funds, currency hedged into Australian dollars. For example, the Bentham Global Income Fund provides exposure to around 600 unique issuers across a range of credit security types.

Accessing global credit and fixed interest

Large portfolios of highly diversified global credit securities are easily accessible to SMSF and institutional investors alike in managed fund format.

Going forward, SMSF investors will be able to access global credit via the ASX. The mFund Settlement Service is a new way for investors to access unlisted managed funds. The service will replace traditional paper-based processes and use an electronic system for settling transactions. This will provide non-institutional investors, such as SMSFs, with a simple and electronic-based system for accessing what has traditionally been an underinvested asset class for individuals.

Bentham is a foundation member of the mFund Settlement Service.