Certain situations arise for some people where an SMSF is no longer an appropriate retirement savings vehicle. Liz Westover looks at some circumstances where exiting an SMSF might be a good idea, as well as a few prudent ways to approach the situation.

The latest ATO statistics indicate more than 1.1 million Australians are using SMSFs as their retirement savings vehicle. For many of these people an SMSF will provide them with the control and flexibility they desire to grow their superannuation savings and then draw down on those savings when they retire. However, as much as an SMSF may be the appropriate choice for a period of time, there may come a time when managing an SMSF is no longer the right choice. All trustees should consider what that would look like for them and develop an exit strategy in case that time arrives.

When exiting an SMSF might be a good idea

There will be many occasions during the life cycle of an SMSF that a trustee should give consideration to the ongoing suitability of their SMSF. Certain events may result in the SMSF no longer being the most appropriate retirement savings vehicle for the members, including:

- lack of time – managing an SMSF takes time. This can include time to manage investments, undertake year-end compliance, manage contributions, and stay abreast of changes in superannuation legislation, rules and rates. If time is in short supply, an Australian Prudential Regulation Authority (APRA)-regulated fund might be a better option,

- declining interest – setting up an SMSF and managing your own investments can initially be exciting. Over time, however, the excitement can wane and the prospect of ongoing management of your investments, even with the help of a financial adviser, can be unappealing,

- low member balances – low or declining member balances can result in the SMSF no longer being cost-effective to continue,

- relationship breakdown – the ongoing responsibility of the SMSF may not be desirable for either party,

- moving overseas – where members are moving overseas, it can be difficult to meet residency requirements of the SMSF, which can result in the fund becoming non-complying,

- risk of non-compliance – if a trustee does not believe they are able to appropriately navigate and adhere to all the relevant superannuation laws, they should not be managing an SMSF,

- age (frailty, mobility, failing eyesight, illness) – SMSFs are frequently set up and/or more actively managed by new retirees as they find themselves with more time on their hands to do so. However, over time the effects of age can become an obstacle to effective management of an SMSF. Lack of mobility or failing eyesight can make undertaking normal tasks more challenging. This is not to suggest it is not possible, only that these are factors to consider when assessing the ongoing appropriateness of an SMSF,

- ill health – declining health including major illness. The ongoing obligations of a trustee following the diagnosis of a significant illness may not be wanted or desirable, and

- cognitive decline – with an ageing population, dementia is becoming an increasingly challenging issue. Where an individual’s ability to make decisions, including major financial decisions associated with managing an SMSF, is compromised, it is likely some action is required in relation to the SMSF. It may include the wind-up of the SMSF or the appointment of an enduring power of attorney (EPOA). An EPOA is not always desirable or there may not be an appropriate person to appoint. Members/trustees must consider how they will manage their SMSF should cognitive decline become an issue.

Timing is everything

It is important trustees consider what they might do long before the above triggers occur. While we don’t always like to think so many of these things could happen to us, the reality is they do. Particularly for advisers, developing an exit strategy with clients is a much easier conversation to have while everyone is fit and well. Cognitive decline can be particularly hazardous, as major financial decisions could be occurring during periods of decline before a formal diagnosis is made. Typically there is a reluctance to get a formal diagnosis as the practical implications for everyday life can be immediate and profound, for example, the loss of one’s driving licence. Having an exit strategy can mean trustees can wind up their funds or appoint an attorney long before a diagnosis is made.

Why is it important to have an exit strategy?

The reality is continuing to manage an SMSF when any of the above factors apply can jeopardise member goals for a comfortable retirement or undermine their savings strategies. It is unlikely, following these triggers, optimum investment decisions are being made or compliance oversight thoroughly undertaken. That is not to suggest trustees must or should wind up their SMSF when any of the above occur, but they should consider their options and make an informed decision about whether to continue with the fund and the impact this may have on their retirement savings.

As much as an SMSF may be the appropriate choice for a period of time, there may come a time when managing an SMSF is no longer the right choice.

Liz Westover

A discussion around possible exit times and triggers can assist some clients to move away from an SMSF with ease when they might otherwise feel a sense of failure when they are no longer able to effectively manage their fund.

Particularly with cognitive decline, and the practicalities associated with it, a methodology or trigger can be put in place to action the exit strategy, for example, attaining a certain age, death of a spouse, serious illness of either spouse members, or upon sale of a business. It does not have to be a diagnosis of cognitive decline, but upon occurrence of possible symptoms. This is often important to assist clients in maintaining their dignity or pride at a time when both are likely being undermined by the effects of their illness.

Thinking about the exit

Annual discussions should be held by members of the fund, with or without their advisers, to consider the ongoing suitability of the SMSF for all members of the fund. Identifying key milestones coming up in the next 12 months is important, such as retirement, big birthdays, major holidays and change of jobs. Will any of these activities impact on the trustee’s ability to effectively manage their fund?

Have any of the triggers above occurred or are they likely to occur in the near future?

Even in the absence of actual events or triggers, thought still needs to be given to what action the trustees would take in the event they did occur and being ready to implement their exit strategy accordingly.

Part of the exit strategy may involve an analysis of the assets in the fund. Factors to consider include whether the assets in the fund are highly illiquid, for which timely disposal will be difficult. If they are, it should be asked if it is time to think about the sale of these assets in readiness for exiting the fund. What is the plan if assets such as business real property are integral to the family business? How will this be managed?

Options for exiting

A number of options exist for exiting an SMSF. The best option will depend on the reason why an SMSF is no longer suitable or why the trustees have decided to cease their SMSF.

The fund can be wound up with benefits being fully withdrawn by the members if they have access to their benefits, having satisfied a condition of release. This might be preferable for members with low-balance funds or where members have high taxable components and they expect their benefits to be distributed to adult children upon their death, who might otherwise pay tax on the taxable component.

The fund can be wound up and benefits rolled over to an industry or retail super fund. Benefits can then be retained in the concessionally taxed superannuation environment while the individual is relieved of the responsibilities of managing their retirement savings in their SMSF.

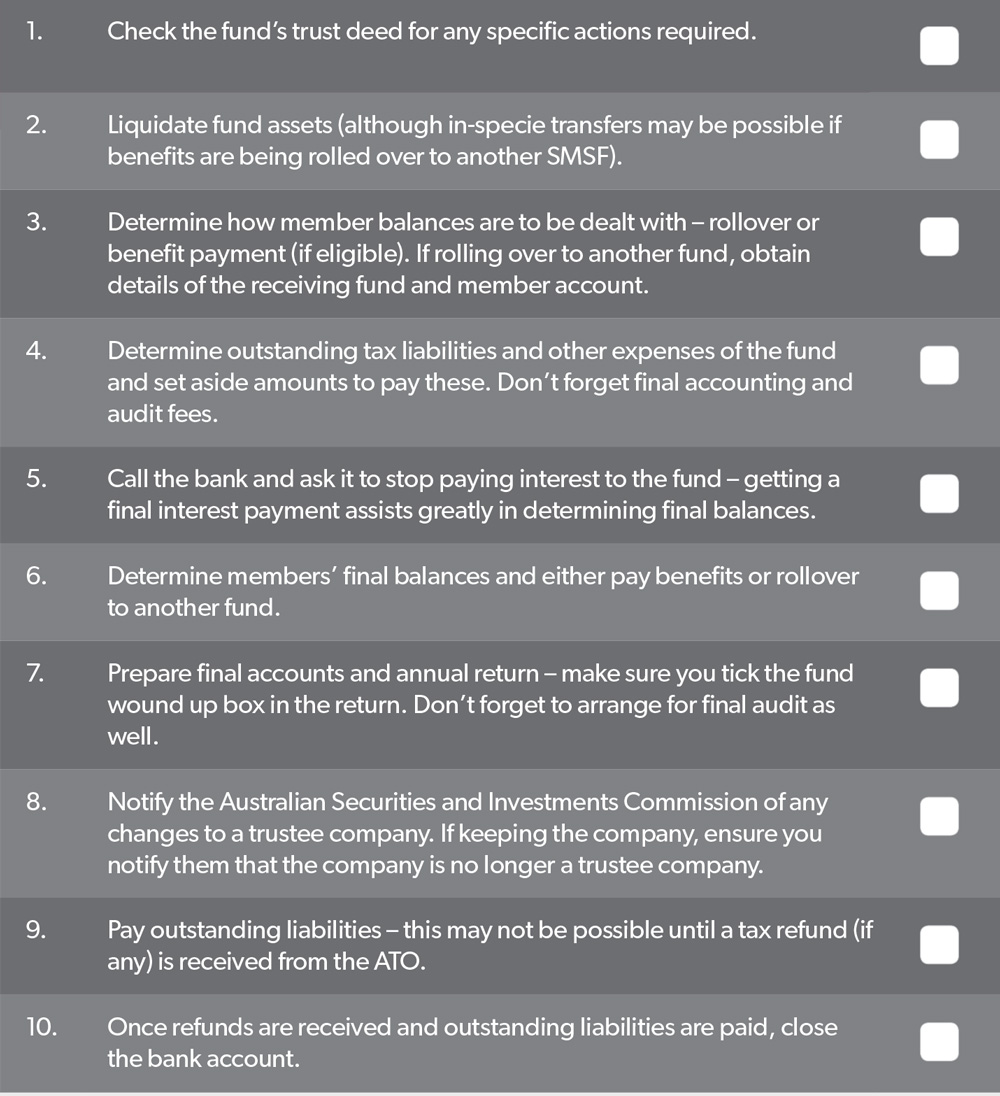

Table 1: Checklist for winding up an SMSF

Alternatively, the members can appoint a professional trustee to look after the fund for them. The fund is not actually wound up, but a new trustee, an approved trustee company, is appointed to take on the responsibilities and compliance obligations of managing the fund. The appointment of a trustee in this way would require the fund to become a small APRA fund (SAF). As a SAF, the fund would no longer come under the jurisdiction of the ATO but instead be regulated by APRA. In years gone by SAFs had a bad reputation as rigid and expensive, but this isn’t necessarily the case anymore. In most cases the new trustee will permit the same assets to be held in the fund and can manage the fund for the members in a reasonably cost-effective way. For example, if individuals want real property, such as business real property, to be maintained within the superannuation environment, a SAF can be the perfect solution.

How to exit your SMSF

Winding up an SMSF can be a daunting task. The activities required aren’t necessarily difficult, but the order in which they occur is all important. Careful planning is the key. While it may seem counter-intuitive, the last thing on the list of activities will be closing the fund’s bank account. Table 1 provides a checklist of things to do – consider doing them in this order also.

ATO assistance

From time to time, an SMSF needs to be wound up, but blockages exist to enable this to happen, including lack of funds to pay an adviser for assistance. In these cases it may be best for the trustees of the fund to engage directly with the ATO to ascertain if it can assist in any way.