The tax treatment of non-bank limited recourse borrowing arrangements has been clouded in recent times, but official guidelines on the subject have now been released. Daniel Butler and Bryce Figot examine the details and implications of the ATO’s compliance move.

The ATO has released important information detailing interest rates, loan-to-value ratios (LVR) and other terms that constitute safe harbours for SMSF limited recourse borrowing arrangements (LRBA) so that arrangements will be taken to be consistent with an arm’s-length dealing. The ATO is officially calling its release a practical compliance guideline (PCG).

Broadly speaking, LRBAs consistent with arm’s-length terms should not give rise to non-arm’s-length income (NALI). On the other hand, LRBAs that are not consistent with arm’s-length terms will attract NALI.

It is important to note here that many refer to non-arm’s-length LRBAs as related-party LRBAs. However, some SMSFs have obtained loans from unrelated parties, such as friends who are not related parties, but still fall under the ATO’s target of LRBAs that are not on arm’s-length terms.

Accordingly, in this article we refer to ‘non-bank’ LRBAs.

Accordingly, this ATO PCG is critical for:

- SMSF trustees who have already entered into LRBAs as action might be required, and

- SMSF trustees who are considering entering into LRBAs that are not financed by a bank.

- SMSF trustees who have already entered into non-bank LRBAs might need to revise the terms of the loan or take other timely corrective action by 30 June 2016. In view of the ATO safe harbours, we strongly recommend a review be undertaken of every LRBA that is not financed by a bank as soon as practicable and in any event prior to 30 June.

Background

At the risk of oversimplifying, to the extent an SMSF has NALI, that income is taxed at a very high rate (47 per cent in the 2016 financial year) even if the fund is in pension mode.

When the predecessor of the current LRBA laws (that is, the old instalment-warrant exception in the now repealed section 67(4A) of the Superannuation Industry (Supervision) (SIS) Act 1993) was first introduced in 2007, a question mark hung over non-bank loans with terms that favour the SMSF.

In 2010, the ATO released Interpretive Decision (ID) 2010/162, which considered whether an SMSF trustee contravenes the arm’s-length provisions of the SIS Act “if it borrows money from a related party of the SMSF under a limited recourse borrowing arrangement on terms favourable to the SMSF?” The ATO answered this in the negative, saying it was not a contravention.

Later on, in the December 2012 National Tax Liaison Group (NTLG) minutes, the issue of interest-free or low interest loans to SMSF trustees was considered. These minutes record that “ATO ID 2010/162 failed to identify whether any other provisions of the superannuation or tax law would be contravened by the trustee entering into a no interest or low interest limited recourse loan arrangement”.

These minutes went on to state: “The ATO position on low-rate loan arrangements and LRBA is that they do not generally invoke a contravention of the SIS, do not give rise to non-arm’s-length income under section 295-550 of the Income Tax Assessment Act 1997 (ITAA), do not invoke Part IVA of the ITAA 1936 and are not considered to give rise to contributions to the SMSF just from that one fact alone.” [Emphasis added.]

Accordingly, this piqued the interest of some in non-bank LRBAs that favour the SMSF.

However, DBA Lawyers has always felt non-bank LRBAs pose risks and NTLG minutes are not binding. Accordingly, we have always cautioned our clients to keep all LRBA terms on an arm’s-length basis.

In December 2014, the ATO released ID 2014/39 and ID 2014/40 (since replaced – but not practically altered – by ATO ID 2015/27 and ATO ID 2015/28 respectively). These both considered non-bank LRBAs with nil interest being charged and both stated the ATO’s view is the arrangements did give rise to NALI.

Accordingly, the position DBA Lawyers had long been in favour of then became broadly well accepted by all in the industry, namely that non-bank LRBAs should be on the same terms that would be agreed with an arm’s-length lender.

In December 2014, the ATO released a page on its website, but has since taken it off, stating: “To be able to demonstrate that NALI does not arise, a fund trustee entering into an LRBA with a related-party borrower should obtain and keep documentation that enables them to establish that the terms of the loan, taken together, and the ongoing operation of the loan are consistent with what an arm’s-length lender dealing at arm’s length would accept in relation to the particular borrowing by the fund trustee.”

Accordingly, the importance of benchmarking terms of non-bank LRBAs to what, for example, a bank might offer, was reinforced to the entire industry.

However, in a practical sense, benchmarking can be difficult. Accordingly, the ATO safe harbours are a very positive step.

Terms of the safe harbour

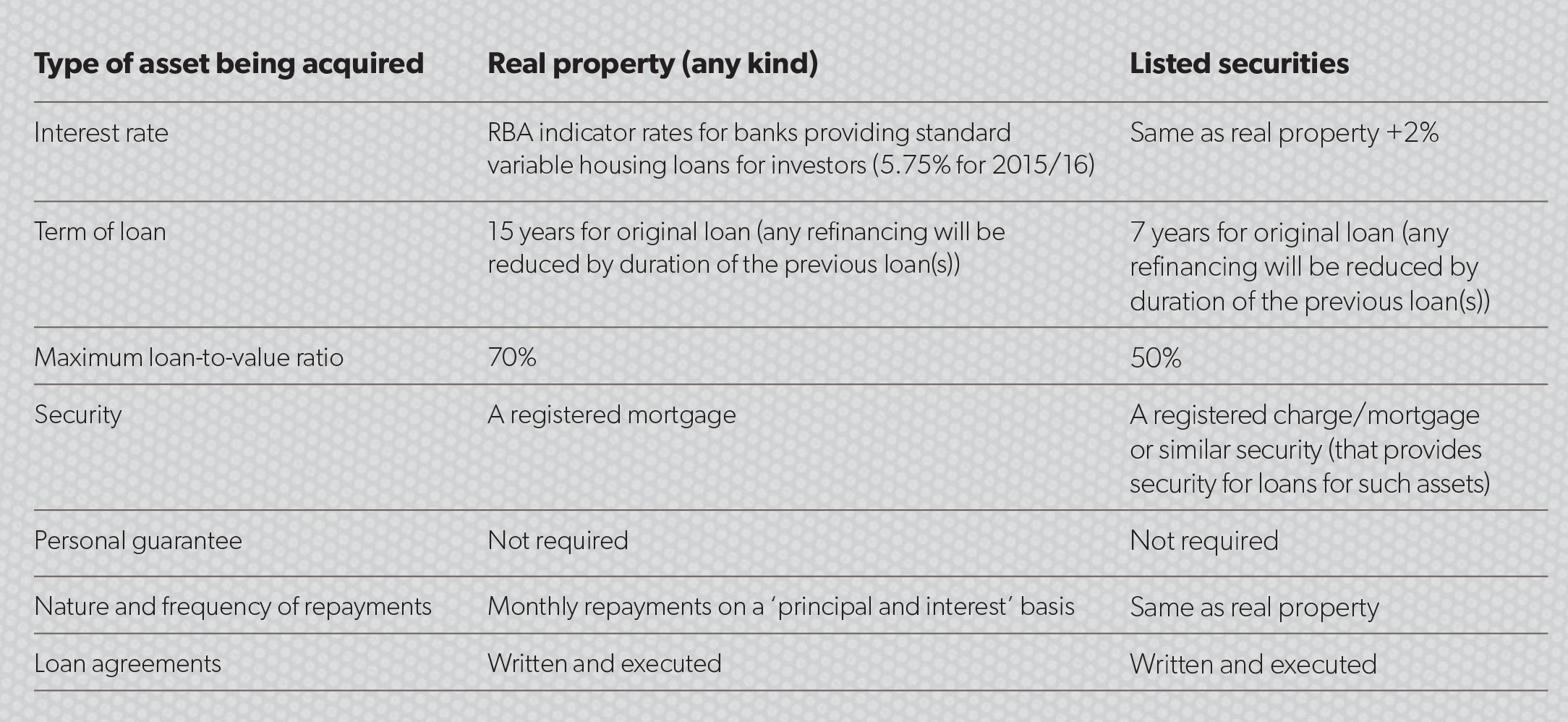

Table 1

PCG 2016/5 “Income tax – Arm’s length terms for Limited Recourse Borrowing Arrangements established by self-managed superannuation funds” states the ATO “will accept that an LRBA structured in accordance with this guideline is consistent with an arm’s-length dealing and that the NALI provisions do not apply purely because of the terms of the borrowing arrangement”.

At the risk of oversimplifying, essentially the terms are as in Table 1.

PCG 2016/5 also provides further detailed guidance regarding the specifics of setting interest rates, particularly for fixed versus variable loans.

What to do if an existing non-bank LRBA does not meet the safe harbour

Advisers should contact all clients with non-bank LRBAs and tell them to read PCG 2016/5 in full.

If the existing LRBA does not meet the safe harbours set out below, PCG 2016/5 provides the following options by 30 June 2016:

- Option 1 – Change the terms so that they are consistent with an arm’s-length dealing by 30 June 2016.

- Option 2 – Bring the LRBA to an end by 30 June 2016.

- Option 3 – Refinance to a commercial lender by 30 June 2016.

The ATO also requires all non-bank LRBAs to be put on arm’s-length terms on or before 30 June. This includes, for example, SMSFs being required to pay a full year’s repayments under loans prior to 30 June. This may place many SMSFs under financial stress given they only have limited time available to come up with substantial cash funding.

Moreover, from 1 July, LRBAs covered by the ATO’s safe harbour will need to make regular monthly repayments of principal and interest. Some existing non-bank LRBAs may have allowed more flexible repayments, such as only requiring annual payments, and some only required full repayment on finalisation of the loan term.

Interesting points to note

Assets not covered by the safe harbours

What should one now make of non-bank LRBAs that are not covered by the safe harbour?

First, the safe harbours in PCG 2016/5 only expressly apply to:

- real property,

- a collection of shares in a stock exchange-listed company, and

- a collection of units in a stock exchange-listed unit trust.

For example, if an SMSF trustee has borrowed from a non-bank to acquire units in a specific class of units in certain managed funds, what action should the SMSF trustee take? Many think of such an investment as being tantamount to a listed security, but technically it’s not.

Perhaps somewhat more controversially, what to do if an SMSF trustee has borrowed to acquire units in a related trust?

Given there is no safe harbour available, the ATO’s comments from December 2014 are more important than ever, namely: “To be able to demonstrate that NALI does not arise, a fund trustee entering into an LRBA with a related-party borrower should obtain and keep documentation that enables them to establish that the terms of the loan, taken together, and the ongoing operation of the loan are consistent with what an arm’s-length lender dealing at arm’s length would accept in relation to the particular borrowing by the fund trustee.”

Therefore the onus is on the SMSF trustee to obtain sufficient and appropriate evidence to support the arm’s-length nature of the terms of their LRBA. This may be difficult where there is no readily available market information and quotes and proposals from third parties and other sources may need to be researched and documented.

Indeed, some may not wish to continue with a non-bank lender and may prefer to refinance with a bank.

Actually calculating the LVR

How is the LVR calculated? More specifically, is the ‘value’ of the real property its value excluding GST, stamp duty and other similar costs? In the absence of ATO clarification, the conservative approach is to assume the answer is yes.

The ATO requires the market value to be established at the time of the relevant loan. Thus, the market value of the asset will generally be at the time of refinancing or, if there is no refinancing, at the date of the original loan.

Multiple assets for one loan

PCG 2016/5 reinforces that it is possible to have multiple loans to acquire one asset. More specifically, it states: “If more than one loan is taken out in respect of the acquisition of the asset, the total amount of all those loans must not exceed [for real property] 70 per cent of the asset’s market value [or 50 per cent for listed securities].”

What does ‘real property’ mean?

PCG 2016/5 refers to real property. On first blush it seems to cover all real property, referring to real property, whether that property is residential or commercial premises (including property used for primary production activities).

However, there are a lot of ambiguous assets which might be seen as real property or might not be so seen, such as:

- A tenants in common interest in real estate – technically this is real property, but the ATO does not expressly mention a non-bank lending to an SMSF to acquire a, for example, 50 per cent tenants in common interest in a house using a 70 per cent LVR and a 5.75 per cent interest rate.

- Life interests in real estate or listed shares/units – technically this is real property, but similar to tenants in common we doubt whether the ATO would be comfortable with an SMSF using these safe harbours to acquire such an asset.

- Shares in a real estate company – there exists company title whereby a property does not have a plan of subdivision per se, but rather comprises a number of apartments and a company owns all the property and by buying, for example, all of the C class shares the owner of the shares has exclusive possession to apartment number three. Technically, such shares are not real property. However, there are certain areas of the laws that essentially allow them to be treated as real property (such as the capital gains tax main residence exemption). The conservative position would be to treat such shares in a real estate company as not constituting real estate for the safe harbour relief and apply to the ATO for SMSF-specific advice.

Don’t interpret the safe harbours for something they are not

The safe harbours do not state that just because the terms in PCG 2016/5 are satisfied, NALI can never occur. Rather, they have the following more restrained comment: “An LRBA structured in accordance with this guideline is consistent with an arm’s-length dealing and that the NALI provisions do not apply purely because of the terms of the borrowing arrangement.” (Emphasis added.) For example, if an SMSF acquires an asset for a non-market value from a related party, NALI could apply (refer to Darrelen Pty Ltd v Commissioner of Taxation [2010] FCAFC 35).

Conclusions

The safe harbours are critically important. They are a very practical solution and the ATO should be commended accordingly for its positive manner in managing these non-bank LRBAs.

All non-bank LRBAs should be reviewed and appropriate action taken by 30 June.